Top 17 EMS Service Providers in Vietnam: A Complete Guide for Electronics Manufacturing

- Introduction

- Key Takeaways

- Tier 1: Global EMS Giants

- Tier 2: Regional Specialists

- Tier 3: Niche Assemblers

- Find Your Fit

- Frequently Asked Questions

- Conclusion

Introduction

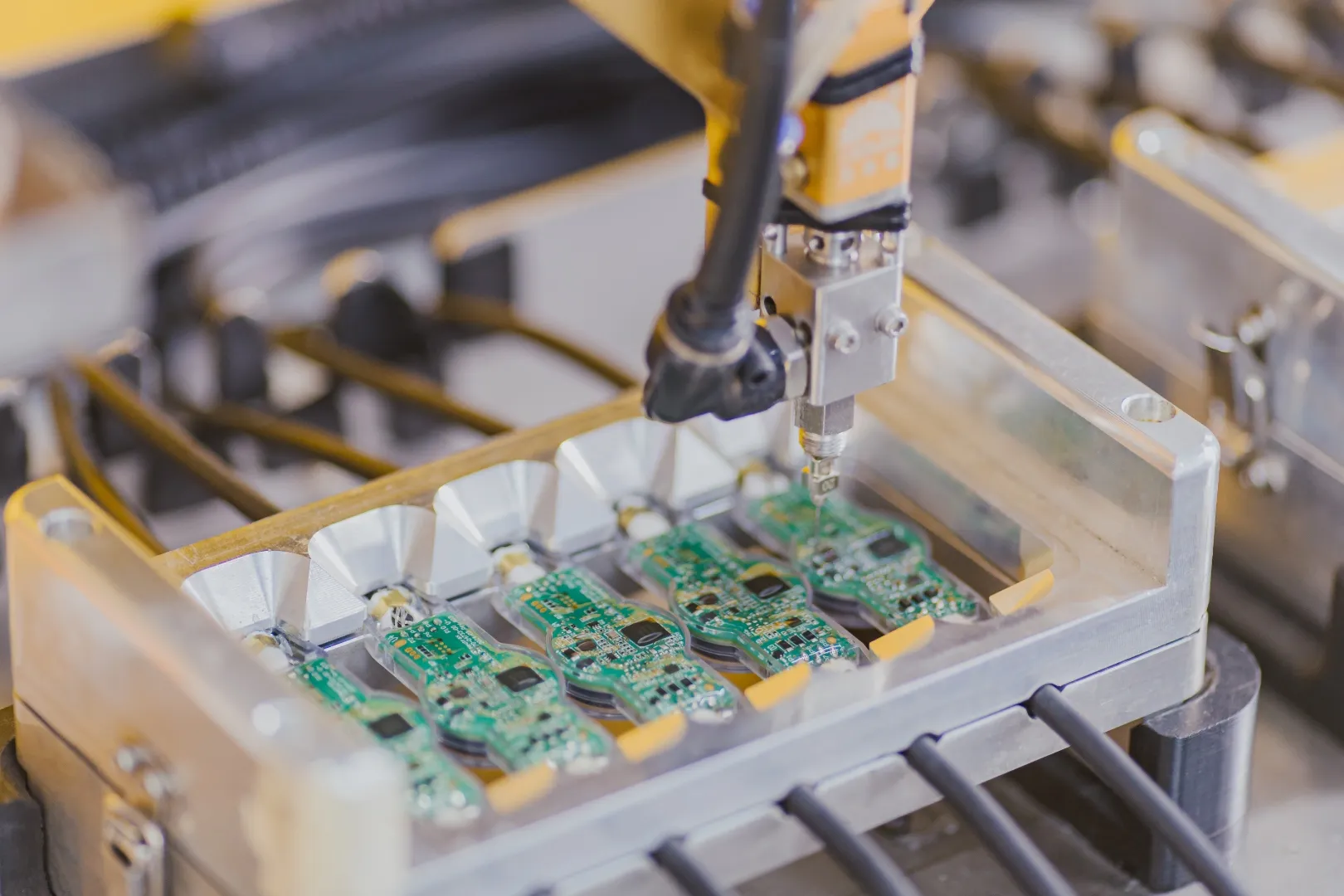

Vietnam is rapidly emerging as a major hub for electronics manufacturing services (EMS) in Southeast Asia, due to its competitive labor costs, improving infrastructure, and strategic trade agreements. Whether you're sourcing high-volume consumer electronics or need turnkey electro-mechanical assembly for industrial IoT devices, Vietnam's diverse EMS ecosystem offers compelling options across multiple tiers.

This comprehensive guide profiles 17 EMS service providers operating in Vietnam, which have all been fully verified. We have organized them by capability tier to help you identify the right manufacturing partner for your product and volume targets.

Key Takeaways

- Vietnam hosts three distinct EMS tiers: Global consumer electronics giants, mid-volume specialists excelling in PCB fabrication, niche providers offering turnkey solutions

- Tier 1 providers like Foxconn and Samsung dominate high-volume consumer electronics but typically require minimum order quantities exceeding 100,000 units annually

- Tier 2 regional specialists offer greater flexibility for mid-volume production (5,000-100,000 units) with strong PCB capabilities and better responsiveness than global giants

- Tier 3 integrated assemblers excel at complex box-build projects requiring electro-mechanical integration, making them ideal for industrial equipment, medical devices, and IoT applications

- Location matters: Northern Vietnam (Bac Ninh, Hai Phong, Hanoi) concentrates on consumer electronics and automotive components, while Southern Vietnam (Ho Chi Minh City, Binh Duong) specializes in industrial and medical electronics

Table of Contents

Tier 1: Global EMS Giants (High Volume / Consumer Electronics)

1. Foxconn (Hon Hai Precision Industry)

- Location: Bac Giang, Bac Ninh

- Core Capabilities: SMT assembly, final assembly, testing, logistics integration, supply chain management

- Best For: Ultra-high-volume consumer electronics, smartphones, tablets, laptops

- Overview: Foxconn operates Vietnam's largest electronics manufacturing facilities, primarily serving as a production base for Apple products like iPads and MacBooks. The company employs over 60,000 workers across its Vietnamese operations. It represents the gold standard for scale manufacturing in the region, with revenue doubling from $3 billion in 2019 to $6 billion in 2020.

2. Pegatron

- Location: Hai Phong

- Core Capabilities: Computing products, networking equipment, consumer electronics assembly

- Best For: Laptops, desktop computers, tablets, networking hardware

- Overview: Pegatron invested $1 billion USD in Vietnam in 2020 and started construction of their first factory in Hai Phong. The facility focuses on information and communication technology products, offering comprehensive services from component procurement through final assembly and testing as part of diversification strategies for major tech brands.

3. Wistron

- Location: Ha Nam

- Core Capabilities: Information products, communication devices, consumer electronics

- Best For: Smartphones, laptops, IoT devices, wearables

- Overview: Wistron's Vietnamese manufacturing base serves as a critical production hub for major technology brands. The company has invested significantly in automation and quality management systems to meet the demanding requirements of tier-one technology clients.

4. Flex Ltd.

- Location: Multiple locations across Vietnam

- Core Capabilities: Full product lifecycle services, automotive electronics, medical device assembly, industrial systems integration

- Best For: Automotive components, medical devices, industrial equipment, consumer products

- Overview: Flex brings decades of global EMS experience to Vietnam with facilities capable of serving diverse industries beyond consumer electronics. Their Vietnamese operations specialize in automotive electronics and industrial systems, offering design support, prototyping, and full-scale manufacturing with stringent quality standards and traceability.

Tier 2: Regional Specialists (Mid-Volume / PCB Focus)

Tier 2 providers excel at PCB fabrication and assembly. They typically handle volumes from 5,000 to 100,000 units annually and offer better responsiveness and lower minimum order quantities than Tier 1 giants. These providers are ideal for established SMEs and companies launching new product lines.

5. VEXOS

- Location: Ho Chi Minh City

- Core Capabilities: PCB assembly, box build, supply chain services, engineering support, metal solutions, membrane switches, display technology

- Best For: Industrial electronics, telecommunications equipment, networking products, medical equipment

- Overview: Founded in 1995, VEXOS focuses on mid-to-high complexity electronics. The company received the Circuit Assembly Service Excellence Award 2021 and serves customers in telecommunications, industrial, and enterprise computing markets with comprehensive services, from prototyping through volume production and aftermarket support.

6. Sunching Electronics

- Location: Binh Duong

- Core Capabilities: High-precision PCB assembly, automated optical inspection, conformal coating

- Best For: Office equipment, imaging devices, industrial printers

- Overview: Sunching Electronics established its Vietnamese operations primarily to serve Japanese clients like Canon. The facility specializes in PCB assembly for products that require high reliability and precise component placement, utilizing advanced inspection systems to ensure quality.

7. Fab 9

- Location: Binh Duong

- Core Capabilities: PCB fabrication, PCB assembly, box build, testing

- Best For: Industrial controls, networking equipment, telecommunications infrastructure

- Overview: Fab 9 combines in-house PCB fabrication with comprehensive assembly services, offering simplified supply chain management and faster turnaround times. Their vertical integration makes them particularly attractive for customers who want to consolidate vendors and reduce coordination complexity.

8. TOKIN

- Location: Multiple South-East Asia locations (including Vietnam)

- Core Capabilities: EMC filters, choke coils, inductors, noise filters, near field communication components

- Best For: Electrical equipment industries, EMC compliance solutions

- Overview: For over 20 years, TOKIN has been producing and supplying components to electrical equipment industries worldwide. The company is certified and compliant with industry requirements and offers diversified product and service solutions across the region.

9. Makipos Electronics

- Location: Hanoi

- Core Capabilities: PCB design, assembly, testing services, IoT solutions

- Best For: Electronics manufacturing with IoT integration requirements

- Overview: Established in 2015, Makipos Electronics is a Vietnamese manufacturer specializing in PCB design, assembly, and testing services. The company provides IoT solutions utilizing advanced technologies to address various client needs in the electrical and electronic manufacturing sector.

10. Foster Vietnam

- Location: Vietnam

- Core Capabilities: Dynamic speakers, magnetic buzzers and sounders, micro-acoustic transducers, audio and visual communication components, automotive components

- Best For: Acoustic products and sound solutions

- Overview: Founded in 1949 globally and established in Vietnam since 2006, Foster has built a reputation as reliable sound specialists. With established green procurement standards and an experienced professional team, the company operates multiple global locations.

Tier 3: Niche & Integrated Assemblers (High Mix / Box Build)

These providers specialize in complete product assembly requiring both electronic and mechanical integration. They excel at high-mix/low-volume production where customization, engineering support, and turnkey capabilities matter more than absolute scale.

Tier 3 providers are perfect for startups, industrial equipment manufacturers, and companies developing specialized products.

11. EMS Vietnam

- Location: Ho Chi Minh City

- Core Capabilities: SMT & THT assembly, cable wire harness assembly, conformal coating, complete box build, testing services

- Best For: Mid-volume industrial electronics, medical devices, and power board assemblies requiring high reliability

- Overview: EMS Vietnam is a dedicated electronics manufacturing service provider based in Southern Vietnam. Unlike providers focused on heavy mechanical fabrication, EMSV specializes in high-quality PCB assembly (PCBA) and system integration. They are an ideal partner for foreign OEMs looking for a reliable factory in Ho Chi Minh City to handle complex board populations, wire harnessing, and final product assembly for industrial and commercial applications.

12. Spartronics (Sparton Vietnam)

- Location: Ho Chi Minh City

- Core Capabilities: PCB assemblies, high-level assemblies, product testing, product design, aftermarket services, medical devices, defense equipment

- Best For: Commercial aerospace components, defense equipment, life sciences equipment, medical devices, instrumentation and control

- Overview: Spartronics provides an array of exceptional services including PCB assemblies, high-level assemblies, product testing, and product design with aftermarket services throughout the product lifecycle. Spartronics serves sophisticated blue-chip customers and is compliant with governmental and global industry requirements.

13. Amtecor

- Location: Ho Chi Minh City

- Core Capabilities: Power electronics, industrial controls, custom cable assemblies, testing, smart TV and LED screen manufacturing

- Best For: Industrial power supplies, motor drives, consumer electronics displays

- Overview: Established in 2014 with grant capital of 30 billion VND, Amtecor has grown to become one of the best EMS providers in Vietnam with high-standard factories and experienced engineers with over 20 years of expertise. The company operates clean factory rooms with 10k dust filters, two automatic assembly lines, and offers 24-month warranties on products.

14. Komaspec Vietnam

- Core Capabilities: Turnkey electromechanical, box build production, custom cable harnesses, PCBA fabrication, sheet metal processing, plastic injection molding, welding, mechanical and electro-mechanical assembly, engineering and design support, reverse engineering, prototyping, component sourcing, inventory management, rigorous quality tracking & testing

- Best For: SMEs, Start-Ups; industries including agricultural, commercial appliances, industrial equipment, IoT devices, mining, automotive peripherals (seeking reduced supply chain risk and access to Vietnam's manufacturing base)

- Overview: Komaspec Vietnam operates a 60,000 sq ft vertically integrated facility in Haiphong (Non-Tariff Zone, Nam Dinh Vu Industrial Park), offering end-to-end EMS with the same quality standards as its China plant. Leveraging Haiphong's port access and proximity to regional supply chains, it provides flexible, high-mix medium-to-high-volume production, lean manufacturing, and shorter lead times. Key capabilities include sheet metal processing, plastic injection, welding, and integrated assembly, supporting diverse non-consumer industries while helping clients mitigate supply chain concentration risks.

15. TOA Vietnam

- Location: Vietnam

- Core Capabilities: Power amplifiers, evacuation sound systems, announcement speakers, wired and wireless microphones, conference systems, audio mixers

- Best For: Audio communication systems, public address systems, conference equipment

- Overview: Founded globally in 1969 and established in Vietnam in 2014 to serve the rapidly growing business market, TOA has over 80 years of experience as a company and supplies to over 150 countries. The company prides itself on meticulous product fabrication and designs with a team of experienced professionals using cutting-edge technologies.

16. IFM Vietnam

- Location: Vietnam

- Core Capabilities: Position sensors, process sensors, power supplies, IIoT software and solutions, IIoT gateway and appliances, IO-Link systems

- Best For: Industrial automation, mobile machinery systems, condition monitoring

- Overview: Founded in 1969, IFM holds numerous certifications and has won multiple awards over the years. The company provides free service hotlines for assistance and actively uses customer feedback to improve services.

17. SOJI Electronics

- Location: Vietnam

- Core Capabilities: Fuel level sensors

- Best For: Automotive fuel level sensing systems, fleet management applications

- Overview: Officially established in 2015 to commercialize LIGO fuel sensors, SOJI has grown into a leading exporter and manufacturer of fuel level sensors across Southeast Asia, especially the Vietnam market. The company occupies over 70% market share in their segment and uses state-of-the-art technologies with connected automated conveyor production lines.

Summary: Which Tier Fits Your Project?

Selecting the right EMS partner depends primarily on your production volume, product complexity, and need for integrated services. This comparison framework helps identify which tier best matches your requirements:

| Provider Tier | Ideal Annual Volume | Ideal Product Type | Best For |

|---|---|---|---|

| Tier 1: Global Giants | >100,000 units/year | Smartphones, laptops, consumer electronics, semiconductors | Global brands needing lowest BOM cost, established products with proven demand, customers requiring massive scale |

| Tier 2: Regional Specialists | 5,000 - 100,000 units/year | Networking equipment, telecommunications, automotive components, specialized electronics | Mature SMEs needing specialized PCB expertise, companies launching new product lines, customers requiring greater flexibility |

| Tier 3: Niche & Integrated Assemblers | 500 - 20,000 units/year | Industrial equipment, IoT devices, medical devices, acoustic systems, complete box-build assemblies | Projects requiring mechanical and electronic integration, startups and scale-ups, products needing turnkey solutions |

Additional Selection Criteria

- Engineering Support Needs: Tier 3 providers typically offer the most hands-on engineering collaboration, while Tier 1 manufacturers expect customers to arrive with production-ready designs

- Regulatory Requirements: For medical devices and automotive applications, verify specific certifications (ISO 13485, IATF 16949) regardless of tier

- Supply Chain Complexity: Tier 1 providers excel at managing complex global supply chains, while Tier 3 partners offer more flexibility in component sourcing and substitutions

- Lead Time Sensitivity: Tier 3 assemblers generally offer faster response times and shorter lead times for prototype and pilot runs

- Intellectual Property Concerns: Smaller Tier 3 providers may offer greater confidentiality and reduced risk of IP exposure compared to large contract manufacturers serving competitors

Frequently Asked Questions

Q1: What makes Vietnam attractive for electronics manufacturing compared to China?

Vietnam offers competitive labor costs (typically 20-30% lower than coastal China) and a growing educated workforce. It also has favorable trade agreements, including CPTPP and EVFTA, which provide tariff advantages for exports to major markets. Many companies view Vietnam as part of a "China Plus One" diversification strategy, reducing concentration risk while maintaining proximity to Chinese component suppliers. The electronics industry achieved export turnover of $126.5 billion in 2024, accounting for one-third of Vietnam's total export value.

Q2: How do I determine the right production volume tier for my project?

Start by estimating your annual production requirements over a three-year horizon (not just first-year volumes). If you anticipate scaling beyond 100,000 units annually within 24 months, consider starting with a Tier 2 provider that can scale or help facilitate transition to Tier 1. For products unlikely to exceed 20,000 units annually, Tier 3 providers offer better economics and flexibility. Remember that minimum order quantities often matter more than theoretical capacity.

Q3: Do Vietnamese EMS providers offer design and engineering support?

Engineering support capabilities vary significantly by provider. Tier 1 manufacturers typically expect production-ready designs with minimal changes. Tier 2 regional specialists often provide DFM (Design for Manufacturability) reviews and optimization suggestions. Tier 3 integrated assemblers frequently offer the most comprehensive engineering collaboration, including design refinement, prototype development, and production troubleshooting. Always clarify engineering support scope during vendor selection.

Q4: What certifications should I look for when selecting an EMS provider?

Required certifications depend entirely on your target market and product category. For medical devices, ISO 13485 certification is essential. Automotive electronics require IATF 16949. Industrial and consumer electronics typically need ISO 9001 at minimum. Export-focused manufacturers should hold relevant environmental certifications (ISO 14001) and social compliance audits (BSCI, Sedex). For defense or aerospace applications, verify AS9100 or equivalent certifications.

Q5: How long does it typically take to onboard with a Vietnamese EMS provider?

The timeline will vary by provider tier and product complexity. Tier 3 providers often complete evaluation and NPI (New Product Introduction) processes in 8-12 weeks for straightforward assemblies. Tier 2 specialists typically require 12-16 weeks for complete qualification including DFM reviews, prototype builds, and process validation. Tier 1 manufacturers may take 16-24 weeks or longer, particularly if tooling investment or supply chain establishment is required. Always factor in additional time for any necessary certification work.

Q6: Can I visit manufacturing facilities before committing to a provider?

Most reputable EMS providers welcome facility tours for serious prospective customers, though company policies vary. Tier 1 manufacturers may require advance scheduling and have restrictions on photography due to confidentiality agreements with existing clients. Tier 2 and Tier 3 providers typically offer greater access. Virtual tours via video conference have become common and can help facilitate initial assessments before investing in travel. Always conduct in-person audits before final contract signing for significant projects.

Q7: What are typical payment terms with Vietnamese EMS providers?

Payment terms vary by provider size, customer creditworthiness, and order volume. New customers with Tier 3 providers typically start with 50% deposit and 50% upon completion or against shipping documents. Established customers may negotiate NET 30 or NET 60 terms after demonstrating payment reliability. Tier 2 providers often offer NET 30 for qualified customers. Tier 1 manufacturers typically require more favorable terms due to their stronger negotiating position. A letter of credit is common for large orders, particularly for new customer relationships.

Conclusion

Vietnam's electronics manufacturing services ecosystem offers compelling options across multiple capability tiers. Providers can support everything from ultra-high-volume consumer electronics to specialized industrial equipment requiring complete turnkey assembly. Your choice of EMS partner should align with your production volume, product complexity, engineering support needs, and long-term scaling plans:

- For established brands producing proven products in volumes exceeding 100,000 units annually, Tier 1 global giants deliver unmatched scale and cost efficiency

- For growing companies and mature SMEs, Tier 2 regional specialists provide the optimal balance of capability, flexibility, and responsiveness for mid-volume production

- For startups, industrial equipment manufacturers, and businesses developing complex products requiring electro-mechanical integration, Tier 3 integrated assemblers offering comprehensive turnkey solutions may be most beneficial

Success with Vietnamese EMS providers requires clearly communicated requirements, realistic volume commitments, and appropriate allocation of engineering resources during the onboarding process. Companies willing to invest time in partner selection and relationship development will find Vietnam's EMS ecosystem capable of supporting diverse manufacturing needs at competitive costs within an increasingly sophisticated supply chain environment.

When evaluating specific providers, prioritize facility visits, reference checks with existing customers, and detailed discussions about engineering support capabilities.

The right EMS partnership extends beyond transactional manufacturing to become a strategic relationship that enables product success and business growth.

About Komaspec: As a turnkey electro-mechanical assembly provider in Hai Phong, Komaspec specializes in complete box-build solutions integrating in-house sheet metal fabrication, plastic components, and electronics assembly. Our comprehensive capabilities allow customers to consolidate vendors and simplify project management for complex industrial products, IoT devices, and equipment requiring close coordination between mechanical and electronic components. Contact our team to discuss your manufacturing requirements.