What Is Electronics Contract Manufacturing?

- Introduction

- Key Takeaways

- What Is ECM?

- What Services Do ECM Providers Offer?

- Top 5 Benefits of ECM

- What Industries Use ECM?

- How to Choose an ECM Partner

- Main Challenges in ECM

- The Future of ECM

- Conclusion

Introduction

Electronics contract manufacturing (ECM) is the outsourcing of design, assembly, and production of electronic components or complete devices to specialized partners. These electronics manufacturers, often called EMS providers, manage complex technical operations like PCB assembly (PCBA), testing, and box builds, allowing companies to focus on innovation and sales.

In 2024, the global electronics manufacturing services market exceeded $720 billion, driven by demand for connected devices, automation, and electric vehicles. ECM enables startups and global OEMs to scale production without investing in factories or managing supply chains.

A professional ECM partner oversees every stage from design-for-manufacturing (DFM), production and testing to certification and logistics, using technologies like SMT, AOI, and ERP-integrated traceability. This model cuts costs, accelerates time-to-market, and ensures consistent quality, making partner selection a strategic priority for any electronics company.

Key Takeaways

- Electronics contract manufacturing allows companies to outsource electronics manufacturing, testing, and logistics to partners.

- Outsourcing electronics manufacturing helps to reduce capital expenditures as much as 30–40% compared to in-house manufacturing.

- Most high-volume projects still look to Asia for cost and scale advantages, as well as access to sub-supplier and component supply chains.

- Nearshore options are increasingly popular, but still lag in scale and cost vs Asian suppliers.

Table of Contents

- Introduction

- Key Takeaways

- What Is Electronics Contract Manufacturing?

- What Services Do Electronics Contract Manufacturers Provide?

- Top 5 Benefits of Electronics Contract Manufacturing

- What Industries Use Electronics Contract Manufacturing?

- How to Choose the Right Electronics Contract Manufacturer

- What Are the Main Challenges in Electronics Contract Manufacturing?

- What Is the Future of Electronics Contract Manufacturing?

- Conclusion

- FAQs

What Is Electronics Contract Manufacturing?

Electronics contract manufacturing (ECM) is the outsourcing of electronic assembly and device production to specialized partners. These partners are often referred to as electronics manufacturing services (EMS) providers. They manage critical processes such as PCB assembly (PCBA), box-build integration, testing, and supply chain coordination. This allows OEMs to focus on core functions like product design and market strategy.

Unlike general contract manufacturing, which can handle plastics, metal, or textiles, ECM focuses on high-precision, component-driven builds that require advanced equipment and sophisticated quality systems.

ECM vs. In-House Manufacturing

Building electronics in-house demands heavy investments in equipment, facilities, and compliance before production even begins. Outsourcing removes these barriers.

Startups leverage ECMs to prototype quickly. Mid-sized firms rely on them for cost stability. Large OEMs use multi-site ECM networks to diversify risk and improve regional speed-to-market.

| Factor | In-House Manufacturing | Electronics Contract Manufacturing (ECM) |

|---|---|---|

| Capital Investment | Requires $3–5M+ for SMT lines, cleanrooms, and tooling | No capital outlay; ECM absorbs infrastructure cost |

| Setup Time | 6–12 months before production readiness | 8-16 weeks for NPI (New Product Introduction) |

| Lead Time Reliability | Varies by internal capacity | ~25% improvement |

| Scalability | Limited to facility and staff capacity | Flexible, multi-site, scalable output |

| Quality Certifications | Must be acquired independently (ISO, IATF) | Already certified to industry standards |

| Operational Risk | Higher (equipment downtime, training) | Shared across multiple client programs |

| Cost per Unit | 25–35% higher | Reduced due to economies of scale and automation |

What Services Do Electronics Contract Manufacturers Provide?

A modern electronics contract manufacturing partner offers far more than basic assembly. These companies integrate engineering, quality control, and logistics under one roof. This enables faster turnaround, higher yields, and better visibility from prototype to shipment.

The best ECMs combine electronic and mechanical manufacturing expertise, supporting both PCB-level and full-system production.

PCB Assembly (PCBA)

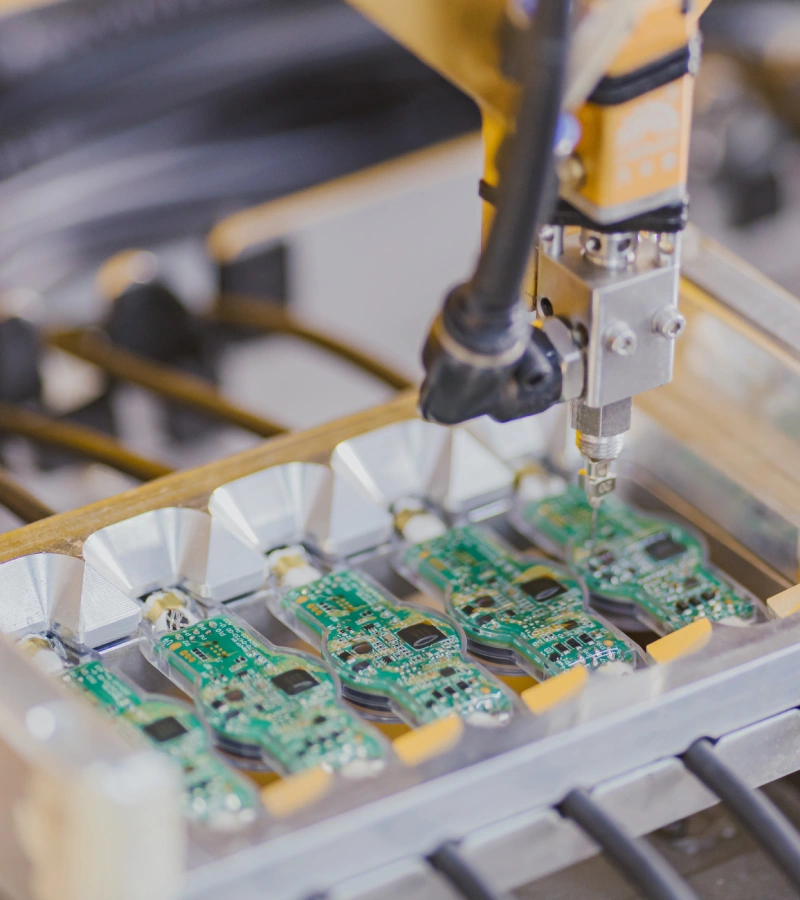

Printed circuit board assembly (PCBA) is the backbone of any electronics manufacturing service. ECMs populate and solder electronic components onto circuit boards using surface-mount technology (SMT) and through-hole assembly.

Box Build and System Integration

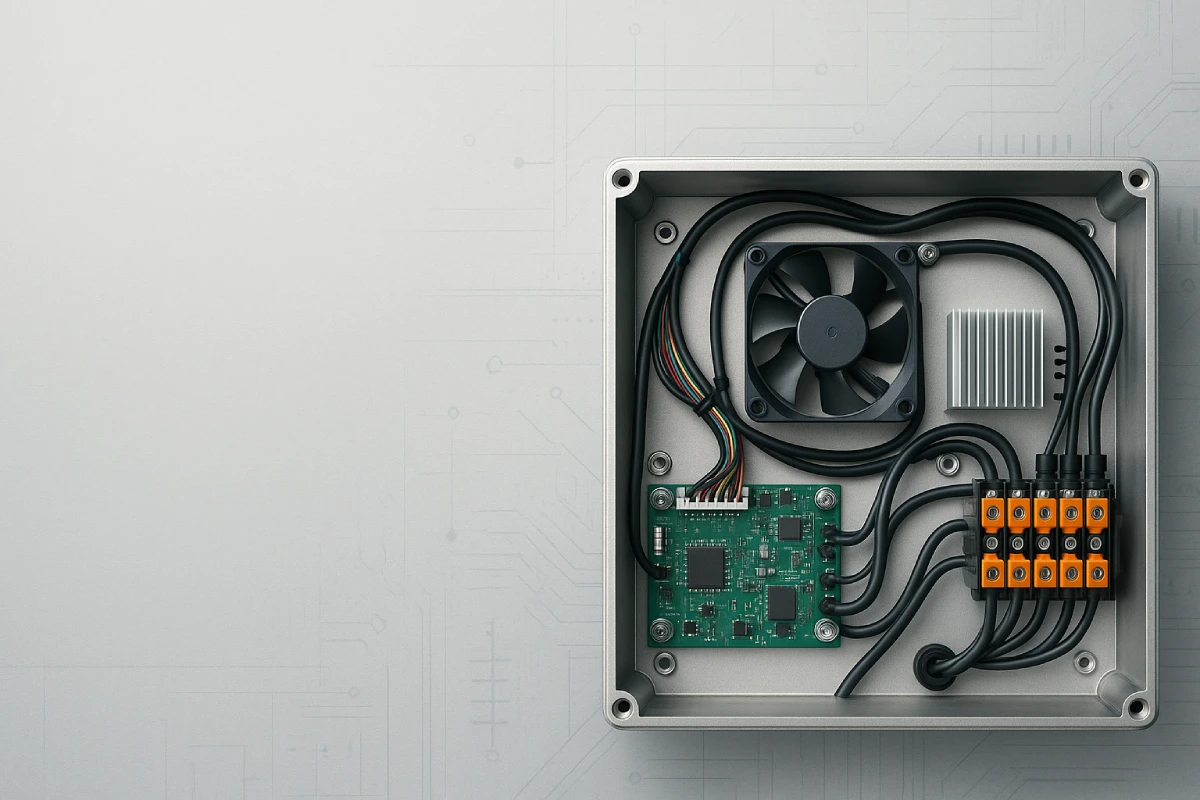

Many ECMs also go beyond the board level, providing box-build assembly, which combines mechanical and electronic sub-systems into complete, ready-to-ship devices.

These box builds may include metal or plastic enclosures, internal harnesses, displays, and user interfaces. At this stage, engineers verify fit, function, and compliance using test jigs and validation tools.

Inspection technologies like AOI (automated optical inspection), ICT (in-circuit testing), and X-ray scanning are standard in professional ECM facilities. These tech-driven processes ensure that every board meets design and compliance specifications before integration.

Cable and Wire Harnessing

Custom cable harnesses and wire assemblies are essential in industrial electronics, medical devices, and EV components.

High-quality ECMs manage crimping, cutting, and labelling automatically, with 100% electrical continuity testing. This minimizes connection failures and simplifies the final assembly.

Testing and Quality Assurance

Testing ensures product reliability before shipment. Leading ECMs run multilayer QA programs, including:

- ICT (In-Circuit Testing): Electrical verification of assembled PCBs.

- Functional Tests (FCT): Real-world simulations using software and power-on diagnostics.

- Burn-In and Environmental Stress Tests: Long-duration tests under heat, humidity, or vibration.

For critical industries, these tests are performed under certified systems (e.g. ISO 13485 for medical devices, or IATF 16959 for automotive components).

Supply Chain and Logistics Support

Electronics contract manufacturers also manage component procurement, supplier qualification, and logistics coordination. With semiconductor lead times still averaging 15 weeks for certain chips, proactive supply chain planning has become a key differentiator among ECMs.

Mature manufacturers maintain approved vendor lists (AVLs), track end-of-life (EOL) components, and coordinate global shipping under Incoterms (FOB, DDP, or EXW).

Some providers can also handle final packaging, labeling, and drop-shipping directly to distribution centers or end customers.

Top 5 Benefits of Electronics Contract Manufacturing

1. Cost Reduction and Operational Efficiency

The most direct benefit of ECM is a lower cost per unit. Established manufacturers operate at massive economies of scale, buying components in bulk and sharing production resources across clients.

Companies also avoid upfront capital expenditures on SMT lines, inspection systems, or cleanroom facilities.

2. Access to Advanced Expertise and Technology

Modern EMS use equipment and engineering talent that are typically out of reach for smaller companies. Capabilities such as 01005 SMT placement, X-ray BGA inspection, and automated conformal coating allow high-density, high-precision builds without additional investment.

Experienced ECM partners also provide Design for Manufacturing (DFM) and Design for Test (DFT) support. This helps customers identify potential assembly issues, component conflicts, and thermal constraints before production begins. These steps routinely improve yield and accelerate time to market.

3. Faster Time to Market

With dedicated NPI (New Product Introduction) lines, established logistics, and ready-to-run tooling networks, ECM partners routinely deliver prototypes and pilot builds faster than in-house teams.

This speed is critical in sectors like IoT and consumer electronics, where product lifecycles average 18 to 24 months and missing a launch window can mean losing entire market cycles.

4. Scalability Without Infrastructure Risk

Once a product is market-ready, ECM makes scaling from pilot runs to full production seamless. EMS providers can multiply output within the same facility or network without major capital outlays.

For instance, a product that starts with 100 pilot units can ramp to 10,000+ units per month using existing SMT lines. And thanks to automated inspection, this scaling can be achieved rapidly without compromising quality.

5. Strategic Focus on Core Competencies

Outsourcing production lets companies allocate more time and capital to higher-value activities like R&D, design, and after-sales support.

Relying on a production partner to manage procurement, assembly, testing, and logistics frees up teams to focus on innovation rather than day-to-day factory management.

For this reason, even large OEMs like Apple, Siemens, and Bosch rely on ECM networks across China and Vietnam for high-volume electronics manufacturing. That way, they can keep their internal focus on engineering and market growth.

What Industries Use Electronics Contract Manufacturing?

ECM supports nearly every sector that depends on reliable electronic systems, from medical instruments to industrial controllers. However, these five sectors account for a majority of the global EMS demand.

Medical Devices

Medical electronics, like patient monitoring systems and diagnostic tools, demand absolute reliability and traceability. ECMs serving this market must adhered to ISO 13485 and FDA 21 CFR Part 820, maintaining full documentation trails from components to calibration.

Automotive and Electric Vehicles (EV)

Global automotive electronics production surpassed $250 billion in 2023, with more than half of that volume coming from manufacturers in China, Vietnam, and Eastern Europe.

Automotive electronics include control modules, sensors, and infotainment systems – all of which require compliance with IATF 16949 certification.

With EV adoption rising, EMS providers are also increasingly involved in battery management systems (BMS), charging interfaces, and power electronics.

Consumer Electronics

This is the largest and most competitive segment of electronic manufacturing. It includes products like smartphones, wearables, and home automation systems. These products are ideal for the ECM model, with high-mix, high-volume EMS providers that can handle short lifecycles and frequent design updates.

EMS hubs in Shenzhen, Dongguan, and Suzhou specialize in these fast-turn environments, with PCB prototyping times as short as 24–72 hours.

Industrial Equipment and Automation

Industrial OEMs depend on ECMs for robust, long-life systems that power machinery, control panels, and factory automation. Typical components include PLC controllers, power supplies, and ruggedized sensor modules.

Unlike consumer devices, these builds prioritize component longevity and environmental tolerance.

IoT and Emerging Technologies

Startups and innovation-focused companies rely heavily on ECM partners to prototype and scale smart devices quickly. From sensor-based IoT nodes to AI-enabled edge devices, these projects demand rapid iteration and flexible production volumes.

Many EMS providers now maintain dedicated NPI (New Product Introduction) lines and digital twins of their assembly processes, allowing startups to go from prototype to shipment in under 8 weeks.

How to Choose the Right Electronics Contract Manufacturer

Selecting the right electronics contract manufacturer is more than a sourcing decision. Done right, it can become a long-term partnership that will shape your product’s quality, cost structure, and market performance. A well-matched ECM brings engineering depth, supply chain stability, and transparent communication, all of which reduce hidden risks across production.

Here are five considerations when evaluating potential ECM partners.

1. Relevant Experience and Proven Track Record

Start by looking for a manufacturer with domain-specific experience in your industry.

For instance, if you want to sell medical products, find an ECM that has shipped ISO 13485-certified medical devices. They will already understand the necessary documentation, traceability, and audit requirements.

But don’t just take their word for it. A strong partner should be able to provide:

- Customer case studies or reference projects

- Compliance documentation

- Sample quality reports or test plans

2. Scalability and Production Flexibility

Your ECM partner should scale production in line with your growth. When assessing EMS providers, ask whether they can handle both low-volume prototyping and mass production under the same roof.

3. Location and Supply Chain Access

Geography directly impacts lead times and logistics costs.

- China remains the largest electronics manufacturing hub, responsible for roughly 32% of global electronics exports.

- Vietnam is emerging quickly, growing electronics exports by 15–20% annually with strong government incentives and tariff benefits under the CPTPP and EVFTA.

- Nearshoring options in Mexico and Eastern Europe appeal to companies prioritizing shorter transit times and easier collaboration.

The ideal choice balances cost, lead time, and supply chain resilience, especially when sourcing critical components like semiconductors or connectors.

4. Communication and Project Management

Without good communication, even ECMs with strong technical capabilities can underperform.

Look for partners that:

- Assign dedicated project managers and engineering liaisons

- Use shared dashboards or ERP-linked systems for live updates

- Provide weekly status reports and production milestones

5. Financial Stability and Long-Term Alignment

Choose a partner capable of sustaining your program through multiple product lifecycles.

Review their ownership structure, annual revenue, and investment in R&D or automation. A stable ECM reinvests in advanced SMT lines, testing automation, and supply chain systems. These are critical indicators that they’re ready to support long-term clients rather than short-term contracts.

What Are the Main Challenges in Electronics Contract Manufacturing?

While ECM delivers major advantages in cost, scale, and speed, it also comes with challenges that must be actively managed.

Global supply chains, compliance standards, and intellectual property laws make the electronics sector complex. By following the right strategies, savvy companies can mitigate these risks and ensure smoother collaboration with manufacturing partners.

1. Minimum Order Quantities (MOQs) and Scaling Challenges

Scaling production efficiently is one of the toughest balancing acts for OEMs. Asian manufacturers often set MOQs of 1,000 to 5,000 units to secure component pricing. North American and European providers may accommodate smaller runs but at higher per-unit costs.

Startups or early-stage hardware companies frequently outgrow their initial partner and must transition from prototype-focused EMS shops to high-volume ECMs, a process that can disrupt continuity if not carefully planned.

Mitigation Strategy:

Use hybrid production models. Many successful OEMs prototype locally for agility, then shift to Asia-based ECMs once demand stabilizes. Vertically integrated partners simplify this transition by supporting both NPI and large-scale manufacturing under one system.

2. Supply Chain Disruptions and Component Shortages

The 2020–2023 semiconductor shortage revealed the fragility of global electronics supply chains. Lead times for key ICs and MCUs surged from 8 - 12 weeks to 40+ weeks, delaying thousands of product launches.

Even as conditions normalize, fluctuations in raw material costs and shipping rates continue to stretch timelines.

Mitigation Strategy:

Robust ECMs maintain multi-tier supplier networks, local component buffers, and active ERP tracking to flag lead-time spikes early. They may, for instance, maintain a list of vetted, alternative vendors to reduce dependency on single suppliers.

3. Quality Consistency at Scale

Maintaining identical quality across thousands (or millions) of units is difficult, especially when multiple subcontractors or facilities are involved.

According to IPC benchmark data, a first-pass yield (FPY) of 90% is often acceptable, but many top-tier EMS providers aim for 98% or higher.

Mitigation Strategy:

Prioritize ECMs with certified ISO 9001 or industry-specific QMS frameworks and automated inspection systems such as AOI, ICT, and X-ray analysis. Routine process capability monitoring and SPC data sharing ensure production stability and traceability.

4. Intellectual Property (IP) Protection

Outsourcing production across borders introduces IP risk. Design files, PCBs, and custom tooling can be replicated if protections are weak or agreements are not legally enforceable. In China and Vietnam, filing trademarks and patents locally remains essential before production begins.

Mitigation Strategy:

Use NNN (non-disclosure, non-use, non-circumvention) agreements drafted in local language. Contracts should also define tooling ownership and serialization procedures. Advanced ECMs store all design data on secure servers to restrict file access to project-specific teams.

5. Global Logistics and Regulatory Compliance

Shipping across borders involves documentation, customs classification, and compliance with export controls like RoHS, REACH, and WEEE.

Delays in customs or missing test certificates can cause costly hold-ups, especially for electronics that contain restricted materials or wireless modules requiring CE/FCC approval.

Mitigation Strategy:

Select an ECM that manages end-to-end logistics, including DAP or DDP shipment options, and maintains dedicated compliance teams familiar with global standards. Many manufacturers now use digital twins of production lines to maintain regulatory traceability from build to delivery.

| Dimension | Key Tension / Trade-Off | Strategic Focus for High-Performance ECMs |

|---|---|---|

| MOQs vs. Flexibility | High minimums limit low-volume experimentation | Build scalable tooling or modular lines |

| Quality Control Overhead | More rigorous checks slow throughput | Use inline inspection (AOI, ICT) and SPC loops |

| Supply Resilience vs. Cost | Buffer inventory increases cost exposure | Multi-sourcing, alternate part planning |

| Logistics Complexity | Global shipping adds unpredictability | Hub balancing, DDP Incoterms, local warehousing |

| IP Exposure | Outsource to third parties increases risk | Enforce NNN, local IP registration, access controls |

What Is the Future of Electronics Contract Manufacturing?

The future of ECM is defined by automation, regional diversification, and sustainability.

1. Automation and Industry 4.0 Integration

Automation is transforming how EMS providers operate.

By 2030, top-tier ECMs are expected to integrate AI-driven process monitoring, robotics, and digital twin simulation into production. Automated SMT (surface-mount technology) lines now achieve placement speeds exceeding 150,000 components per hour, reducing defect rate below 0.5% when paired with closed-loop optical inspection systems.

Contract manufacturers will also increasingly leverage Industry 4.0 frameworks, linking ERP, MES, and IoT sensors to achieve real-time visibility throughout the entire process.

2. Nearshoring and Regionalization

Global disruptions and geopolitical shifts are driving OEMs to diversify production beyond China. Manufacturers are increasingly adopting multi-country sourcing models, splitting production between Asian and North American facilities to balance cost and risk.

3. Sustainability and Green Manufacturing

Environmental accountability is rapidly becoming a critical factor for OEMs. Many global electronics buyers now require proof of ISO 14001 environmental management and carbon reporting from their ECM partners.

To meet these demands, factories are investing in:

- Lead-free soldering and energy-efficient reflow ovens

- Solar-assisted production lines

- Recyclable packaging materials to reduce shipping waste

Sustainability also extends to materials traceability, particularly for batteries, rare earths, and plastics. ECMs capable of meeting EU Ecodesign and REACH standards will gain long-term competitive advantage as global green regulations tighten.

Conclusion

Electronics contract manufacturing has evolved from a transactional service to a strategic partnership model. Today’s OEMs rely on ECMs not only for cost savings but for engineering collaboration, compliance assurance, and supply chain resilience.

The global electronics manufacturing market, projected to exceed $300 billion, will favor companies that outsource production to scalable, tech-driven partners.

At Komaspec, our integrated approach, which spans design-for-manufacturing (DFM), box-build assembly, testing, and logistics, helps companies turn complex designs into reliable, market-ready products.

To learn more about how we support end-to-end electronics manufacturing programs, contact our team or visit our Electronics Manufacturing Services page.

FAQs

Q. Which industries rely on electronics contract manufacturers?

The ECM model is used to produce electronics across a vast number of sectors. Major industries that rely on ECM include medical device manufacturing, automative (including electric vehicles), consumer electronics, and industrial equipment.

Q. Can the ECM model be used for complex products?

Yes. While some ECMs will only produce relatively simple components (like printed circuit boards), many will also have the equipment and expertise to manufacture box builds, integrated systems, and industrial electronics.

Q. Is ECM better than in-house manufacturing?

It depends on your company’s goals. Building products in-house can give your company more control over the production process. However, in-house manufacturing is cost-prohibitive for most companies, since it involves significant upfront investments in facilities and equipment, not to mention engineering and design talent.

Q. What are the benefits of the ECM model?

Outsourcing production to an ECM affords a number of benefits. The most obvious ones are cost-efficiency, access to specialized manufacturing capabilities, and engineering expertise. ECMs also enable rapid scaling, faster time to market, and greater investment in core functions like R&D and marketing.

Q. How can I protect my intellectual property when working with an EMS provider?

IP protection is an important but often overlooked aspect of an outsourcing strategy. Careful planning is required to ensure that you retain the rights to your designs and custom tooling. Be sure to file trademarks and patents where your ECM is based (before production begins). An NNN (non-disclosure, non-use, non-circumvention) agreement in the local language is also advisable.