How to Find a Contract Manufacturer in Vietnam

- Introduction

- Key Takeaways

- Why Choose Vietnam for Contract Manufacturing?

- Understanding Vietnam’s Manufacturing Landscape

- Step-by-Step Guide to Finding a Contract Manufacturer in Vietnam

- Vietnam-Specific Manufacturing Challenges

- How Much Does it Cost to Manufacture in Vietnam?

- Legal and Compliance Implications

- Find the Right Manufacturer for Your Needs

- FAQs

Introduction

To find a contract manufacturer in Vietnam, start by:

- Defining your product specifications, target volumes, and quality standards.

- Research potential partners through Vietnamese B2B directories, trade shows, and sourcing agents, and narrow your shortlist by verifying licenses, certifications, and factory capabilities.

- Perform due diligence: request samples, visit factories or hire third-party auditors, and review their quality systems and raw material sourcing.

- Finally, negotiate a detailed manufacturing contract that protects your intellectual property and sets clear payment terms, quality clauses, and contingency provisions.

Vietnam’s labor costs are about 50% lower than China’s, and the country’s broad network of free trade agreements makes it an attractive manufacturing hub. However, understanding local challenges such as infrastructure gaps and supply chain dependencies is essential for success.

Key Takeaways

- Vietnam offers competitive advantages as a manufacturing hub, including significantly lower labor costs (around 50% less than China), modern infrastructure, and strong trade agreements.

- Multiple manufacturing models (OEM, ODM, and CM) offer flexibility and customization of the production process.

- Finding the right contract manufacturer in Vietnam involves clear product definition, supplier research, thorough vetting (including audits), and well-structured contracts.

- Vietnam faces infrastructure gaps, labor shortages, and regulatory complexity. Because of this, many suppliers still rely on Chinese imports.

Table of Contents

- Introduction

- Key Takeaways

- Why Choose Vietnam for Contract Manufacturing?

- Understanding Vietnam’s Manufacturing Landscape

- Step-by-Step Guide to Finding a Contract Manufacturer in Vietnam

- Vietnam-Specific Manufacturing Challenges (And How to Mitigate Them)

- How Much Does it Cost to Manufacture in Vietnam?

- What Are the Legal and Compliance Implications of Contract Manufacturing in Vietnam?

- Find the Right Manufacturer for Your Needs

- FAQs

Why Choose Vietnam for Contract Manufacturing?

While China has traditionally been seen as the go-to source for overseas contract manufacturing, more companies are looking to Vietnam as an appealing alternative. Low labor costs, modern infrastructure, and strong agreements with the U.S, EU, and Japan make it a favorable choice.

Key Advantages

Manufacturing in Vietnam is often seen as less risky than contracting in other countries. This is due to several benefits, such as:

- Significant Labor Cost Advantage: Labor costs in Vietnam are approximately 50% lower than in China, with average wages around $2.99/hour compared to $6.50/hour in China.

- Extensive Free Trade Network: Vietnam is part of over 15 Free Trade Agreements (FTAs), including major global pacts like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), EU-Vietnam Free Trade Agreement (EVFTA), and Regional Comprehensive Economic Partnership (RCEP).

- Strategic Geographic Location: Vietnam offers easy access to key ASEAN (Association of South East Asian Nations) markets and major global shipping routes.

- Pro-Business Policies and Infrastructure: The Vietnamese government promotes foreign investment with tax incentives, streamlined regulations, and a growing network of industrial zones equipped with modern infrastructure

Industry Strengths

Vietnam has more to offer than affordable labor and strong trade agreements. The region is also becoming known for its deep expertise in a number of industries:

- Textile & Apparel Firms: Vietnam is home to more than 6,000 textile and apparel companies that pair quality production with competitive pricing.

- Electronics: Global giants like Samsung, Foxconn, and Intel base some of their manufacturing in Vietnam because of its strong government incentives and large pool of skilled engineers.

- Furniture (Especially Outdoor): Central provinces like Binh Duong and Quang Nam have become major hubs for exporting outdoor and wooden furniture to large retailers in the U.S. and Europe.

- Footwear & Leather Goods: Vietnam is a top exporter of footwear and leather goods, producing shoes for brands like Nike, Puma, and Vans.

- Food Processing: Vietnam’s rising food safety standards make it well-positioned to support contract manufacturing in processed foods, beverages, and nutritional products.

Understanding Vietnam’s Manufacturing Landscape

Manufacturing in Vietnam is characterized by regional specializations and a variety of supplier models designed to meet different production needs.

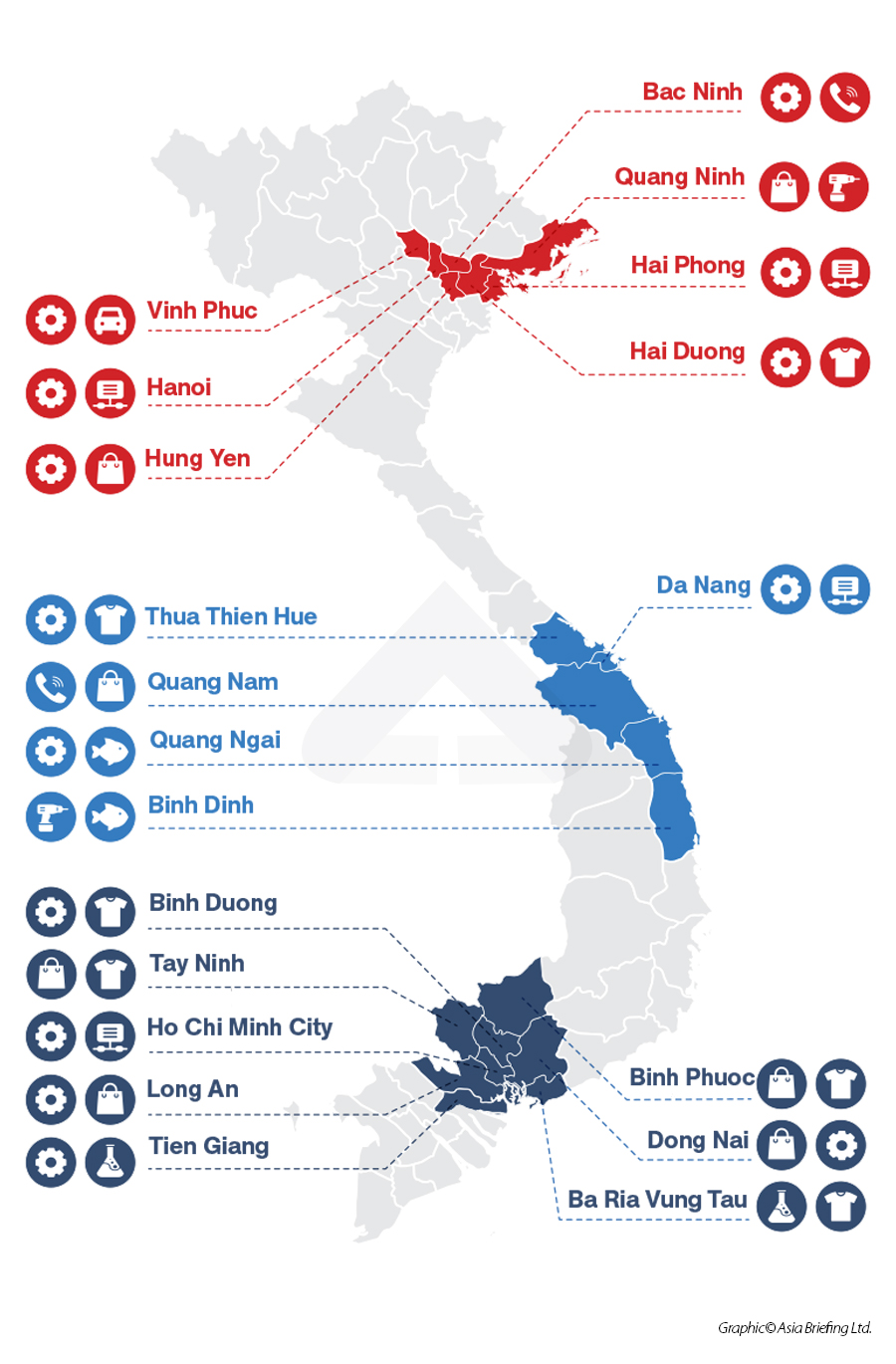

Major Regional Manufacturing Hubs

Vietnam’s manufacturing hubs are strategically distributed across the country, each with its own industrial strengths. These regional clusters give Vietnam a flexible manufacturing base that is capable of supporting a vast range of industries.

| Region | Major Cities | Key Industries | Logistics & Trade | Labor Market | Infrastructure |

|---|---|---|---|---|---|

| North Vietnam |

|

|

|

|

|

| South Vietnam |

|

|

|

|

|

| Central Vietnam |

|

|

|

|

|

North Vietnam (Hanoi, Bac Ninh)

- The northern region (especially Hanoi and Bac Ninh) is a high-tech and electronics manufacturing hub.

- Its proximity to China allows manufacturers to efficiently source components and machinery.

- Its strong infrastructure and skilled workforce attract global tech players like Samsung, Canon, and Foxconn.

South Vietnam (Ho Chi Minh City, Binh Duong, Dong Nai)

- The southern region is the industrial heartland of Vietnam and was one of the first areas to industrialize, primarily with smaller / homegrown industries.

- It hosts manufacturers in a broad range of industries, from furniture and textiles to automotive components and packaging.

Central Vietnam (Da Nang and surrounding areas)

- Da Nang and nearby provinces are growing hubs for outdoor furniture, wood products, and small-to-medium scale factories.

- Central Vietnam offers lower labor and land costs, making it ideal for manufacturers looking for niche production with more flexibility and room for expansion.

Types of Manufacturers in Vietnam

Vietnam is home to a variety of manufacturer types. These different production models allow businesses to choose the right level of involvement, customization, and speed for their production goals.

| Category | OEM | ODM | CM |

|---|---|---|---|

| Design Responsibility | Buyer provides design and product specifications | Manufacturer owns and provides the product design | Buyer provides full design and production instructions |

| Intellectual Property Owner | Buyer | Manufacturer | Buyer |

| Customization Level | High | Medium | High |

| Speed to Market | Slow/Medium | Fast | Medium |

| Cost | Medium/High | Low | Varies |

| Use Cases | Tech, Automotive, Electronics | Electronics, Fashion | Pharmaceuticals, Food, Industrial |

OEM (Original Equipment Manufacturer)

- With OEMs, you provide the industrial design and requirements, and the manufacturer produces your product leveraging their existing supply chain and technology.

- This model is ideal if you have your own R&D and branding but need reliable, scalable production.

- There’s some room for customization, but IP ownership is mixed and tooling costs can be considerable

ODM (Original Design Manufacturer)

- In an ODM model, the manufacturer owns the product design, and you brand and sell it as your own.

- This approach shortens development time and reduces upfront costs.

- The downsides are limited IP protection, and more “cookie cutter” products.

CM (Contract Manufacturer)

- Contract manufacturers (CMs) offer a flexible, service-based production model, often working under your specifications but without contributing design or branding.

- The time to development is longest, and can be more costly.

- This offers greatest customization options, product control and IP protection.

Step-by-Step Guide to Finding a Contract Manufacturer in Vietnam

Finding a contract manufacturer in Vietnam requires a strategic approach that goes beyond simple cost comparisons. But with the right due diligence, you can find a reliable Vietnamese manufacturer that aligns with your expectations about budget, timeline, and quality.

Step 1: Define Your Requirements

- Before reaching out to any manufacturer, clearly define your product and production needs:

- Include detailed product specifications, including materials, dimensions, and tolerances

- Clearly state target volumes for both initial and future projections

- Include quality and compliance standards, including ISO, CE, and UL

Also, factor in Vietnam-specific challenges such as:

- Raw material sourcing

- Logistics constraints

Step 2: Research and Identify Potential Suppliers

You can use both online platforms and B2B marketplaces to find and connect with manufacturers, including:

Online platforms

- Alibaba is widely used but requires careful vetting

- VietnamExport.gov.vn is an official B2B directory from VIETRADE

- VietFactory, VietnamAZ, and VietnameseMade.com are B2B sourcing sites focused on Vietnam-based manufacturers

Trade shows

- Vietnam Expo (also known as Vietnam International Trade Fair) is an annual event for international trade and business matchmaking

- Metalex Vietnam is an annual event for machinery and industrial goods

Local sourcing support

- Trade promotion agencies like VIETRADE

- Bilingual sourcing agents or Western-managed sourcing firms

Step 3: Initial Screening

Once you’ve narrowed down suitable candidates, conducing an initial screening can help you quickly vet options and avoid wasting time with unsuitable manufacturers. This process should include:

- Verifying licenses and certifications

- Checking social and labor compliance

- Evaluating communication skills and English proficiency

- Confirming factory capabilities (Do they specialize in your product category? Can they meet your desired production volumes?)

Step 4: Send RFQs (Requests for Quotation)

The next step is to get quotes from the manufacturers who passed the screening.

- Provide clear documentation that includes specs, tolerances, materials, packaging, and target price ranges

- Address Vietnam-specific issues such as shipping lead times, tariffs, or raw material sourcing

- Request samples or process validation to verify their capabilities before moving forward

Step 5: Assess and Audit

Before moving forward with a manufacturer, take the time to thoroughly evaluate their operations.

- Visit the factory or hire a third-party auditor

- Review quality systems (Do they follow ISO 9001? Do they conduct in-house inspections?)

- Investigate their raw material sourcing (Are they heavily dependent on Chinese imports? How diversified is their supply chain?)

Step 6: Negotiate and Contract

After a thorough assessment, solidify the terms of your partnership.

- Establish payment terms (avoid large upfront deposits without safeguards in place)

- Include quality control and rework clauses

- Establish IP protection by including NDAs and legal contracts

- Include force majeure clauses to protect against unforeseen events

- Confirm infrastructure reliability, such as backup power systems and proximity to ports

Step 7: Pilot Production

Once you’re ready to move ahead with a manufacturer, don’t go all-in straight away.

- Run a pilot batch to test production processes, quality control, and logistics

- Establish communication protocols, iron out misunderstandings, and validate timelines

- Only scale up once initial production runs have proven successful

Step 8: Relationship Management

Ongoing communication and evaluations are essential to ensuring a productive long-term relationship with a manufacturer.

- Set clear KPIs and performance expectations

- Conduct factory audits periodically to ensure standards are maintained

- Build transparent communication channels, ideally with a local third-party

- Handle issues collaboratively to build trust and alignment

Vietnam-Specific Manufacturing Challenges (And How to Mitigate Them)

While Vietnam offers significant advantages for contract manufacturing, it also presents a unique set of operational challenges.

Key Challenges

- Infrastructure Gaps: Vietnam’s infrastructure is improving, but continues to struggle with power outages, port congestion, and underdeveloped roads.

- Skilled Labor Shortages: Demand for skilled workers is growing and often outpaces supply.

- Regulatory Changes and Bureaucracy: Customs procedures, tax laws, and import/export regulations vary by province and can be subject to change.

- Inconsistent Quality Across Suppliers: Quality can vary widely between suppliers and even between batches, especially when weak quality control systems are in place.

- Import Dependence on China: Many Vietnamese factories still rely heavily on components and raw materials sourced from China.

Mitigation Tips

- Partner with bilingual sourcing agents or Western-managed firms to ensure clear communication without sacrificing knowledge of local manufacturing and regulations

- Invest in training and supplier development

- Add buffer times to project timelines to reduce the impact of delays

- Use third-party quality inspections and define strict tolerances and quality standards

- Diversify your supply chain across multiple suppliers or regions

How Much Does it Cost to Manufacture in Vietnam?

Vietnam offers some of the lowest production costs in Asia, but accurate budgeting requires a detailed understanding of both direct and indirect expenses.

Below is a breakdown of the main cost components, including the hidden ones you’ll want to anticipate.

Cost Breakdown

- Labor: Vietnam’s labor costs are among the lowest in the region, averaging around $2.99/hour, which is significantly cheaper than labor rates in China.

- Raw Materials: Many components are still imported, often from China. Be sure to plan for foreign exchange fluctuations and customs duties.

- Shipping & Logistics: Exporting from Vietnam involves freight forwarding, inland transport, and port handling fees.

- Inspection & Compliance: Third-party quality control inspections are essential but add to your per-unit cost. Compliance with international standards and country-specific import regulations may require additional certifications or documentation, which carry their own expenses.

- Tariffs, VAT, and Customs Costs: Vietnam applies a 10% Value-Added Tax (VAT) on most goods, which may be refundable upon export. Be sure to factor in tariff classifications, customs clearance fees, and any import duties on materials sourced from outside Vietnam.

- Infrastructure Buffers: Given the risk of power outages, port congestion, and road delays, you may also want to budget for added warehousing, generator use, or alternative transport options to avoid costly interruptions.

Hidden Costs

Even seemingly airtight budgets can be derailed by unplanned expenses. Make sure to account for common hidden expenses, such as:

- Communication Gaps: Miscommunications can lead to production delays or incorrect orders.

- Rework Due to Quality Control Issues: Defective products or inconsistent batches may require rework or replacements.

- Extra Logistics Handling: Vietnam’s supply chains can be fragmented, especially if you’re relying on raw materials, factories, and export ports from different regions.

What Are the Legal and Compliance Implications of Contract Manufacturing in Vietnam?

While production costs are a prominent consideration, there are also legal and compliance issues to take into account.

Legal and Compliance Requirements

- Manufacturers in Vietnam must hold the necessary business licenses and be compliant with local labor laws.

- Verify that your supplier has updated Environmental Health & Safety (EHS) documentation and certifications to avoid scrutiny or fines.

International Compliance Standards

- Your products may need to comply with standards like CE marking, RoHS, and ISO 9001/14001. These certifications should be factored into your cost and timeline planning.

- Patents, trademarks, and designs should be registered locally through the National Office of Intellectual Property (NOIP), especially if you're working with ODMs or sharing proprietary designs.

What to Include in Your Contracts

- Worker protections and subcontracting limitations

- IP protection clauses with restrictions on design reuse and third-party disclosures

- Certificates of origin, customs declarations, and product testing reports

- Dispute resolution terms

Find the Right Manufacturer for Your Needs

Vietnam is beginning to rival China as a center for global contract manufacturing. But companies that wish to source their manufacturing in Vietnam should understand the local dynamics, invest in long-term relationships, and prioritize quality control systems to ensure their goals are achieved.

At Komaspec, we bridge the gap between global expectations and local execution. With deep, on-the-ground experience in Vietnam, we provide end-to-end support with sourcing, manufacturing, quality control, and logistics. If you’re ready to explore contract manufacturing in Vietnam, we’ll help to ensure you get Western-quality outcomes with the speed and cost-efficiency Vietnam is known for.

FAQs

What makes Vietnam a good choice for contract manufacturing?

Vietnam offers competitive labor costs, a growing skilled workforce, and improving infrastructure. Its strategic location in Southeast Asia also gives it access to global shipping routes and key markets. Additionally, Vietnam has signed multiple free trade agreements, reducing tariffs and expanding export opportunities.

What industries are most common for contract manufacturing in Vietnam?

Vietnam is well-known for contract manufacturing in a number of industries, including textiles and garments, furniture, and consumer electronics. The country has also become a hub for footwear, automotive parts, and metal fabrication.

How can I find reputable contract manufacturers in Vietnam?

Start by researching your options through trusted B2B platforms like Alibaba, Global Sources, or Vietnam-based directories such as VietnamExport or VCCI. Attending trade shows like Vietnam Expo or Metalex Vietnam can also connect you directly with vetted suppliers.

What should I look for when evaluating a potential manufacturer in Vietnam?

When evaluating a potential manufacturer, look for production capabilities that match your product requirements, including equipment, capacity, and lead times. Assess their quality control processes, certifications (like ISO and BSCI), and experience with similar products or clients.

Can I visit the factory before signing a deal?

Yes, you can. In fact, visiting the factory before signing a deal is highly recommended. It allows you not only to verify production capabilities and assess working conditions, but also start build trust with the manufacturer. A site visit will also help you identify any potential risks or issues early in the partnership.