Manufacturing in China vs. Vietnam: Which Is Superior?

- Introduction

- Key Takeaways

- Why Compare China and Vietnam for Manufacturing?

- Manufacturing in China

- Manufacturing in Vietnam

- Key Factors to Consider

- Do You Have to Choose Just One?

- Conclusion

- FAQs

Introduction

Choosing between China vs. Vietnam for your manufacturing needs was once a simple cost-based decision. Now, it has become a strategic consideration that involves a number of critical factors like shifting trade dynamics, increased supply chain complexity, risk of IP infringement, trade agreements, and governmental support.

Historically, China dominated high tech, large scale production with engineering services. However, in recent years, Vietnam has evolved into a powerful hub for contract manufacturing, with compelling advantages of its own.

In this article, we will explore the pros and cons of China vs. Vietnam manufacturing and provide a side by side comparison to help you decide which option is right for you.

Key Takeaways

- China still remains the global leader in high-tech, large volume manufacturing, thanks to its vast infrastructure and supplier ecosystem.

- Vietnamese’s labor costs are better than China’s, along with growing industrial capabilities.

- For many companies, dual sourcing is the best option, with parts sourced from China and assembled in Vietnam to mitigate manufacturing risks, minimize tariffs, and save on overall costs.

Table of Contents

Why Compare China and Vietnam for Manufacturing?

While China used to be the default hub for contract manufacturing, Vietnam has recently emerged as an appealing alternative.

Both countries offer unique strengths that are increasingly relevant in a multipolar sourcing environment. But they also bring their own respective challenges that must be taken into consideration when evaluating manufacturers.

Global Trends Affecting Contract Manufacturing

China has long dominated global manufacturing, thanks in large part to its vast and well-established manufacturing infrastructure, world-class equipment, skilled labor, and unmatched production scale and speed.

However, rising labor costs, tariffs, and geopolitical tension have caused many companies to rethink their “China only” sourcing strategy, with Vietnam becoming one of the main alternatives.

Labor, Tariffs, and Supply Chain Disruption

Vietnam contract manufacturing has emerged as a favorable option due to its cost-competitive labor market and integration into international trade networks. Its geographical location, bordering China, makes it ideally positioned along major Asia-Pacific trade routes.

While salaries in China are on the rise, those in Vietnam continue to trail behind. In 2023, labor costs in Vietnam were 40% to 60% lower than those found in China.

FDI-friendly policies further encouraged the shift to Vietnamese manufacturing. These have attracted foreign investments in high-tech and export-driven manufacturing, allowing the country’s manufacturing hubs to grow larger and more sophisticated as a result.

Another factor is improved trade network access, such as eliminating tariffs on 99% of goods and duty-free access to Canada, Mexico, and Japan.

Why China and Vietnam Are Seen as the Top Two Options for Overseas Manufacturing

Both China and Vietnam countries offer robust infrastructure, including deepwater ports, modern industrial parks, efficient logistics networks, skilled labor, and strong government support for manufacturing.

China excels in high-volume, high-complexity production, with deep, historical supply chain capabilities.

Vietnam, on the other hand, offers contract manufacturing with compellingly low labor costs, trade deal benefits, and lower geopolitical exposure, especially for companies exporting to the West.

While not the only game in the continent, China and Vietnam form the strategic core of Asia’s contract manufacturing ecosystem. Together, they provide a strong foundation for any company seeking efficient and effective manufacturing.

Manufacturing in China

Although other countries are boosting their manufacturing capabilities, none compare to China. It is the world’s largest manufacturing hub and is supported by quality and production reliability, scalability, and affordability.

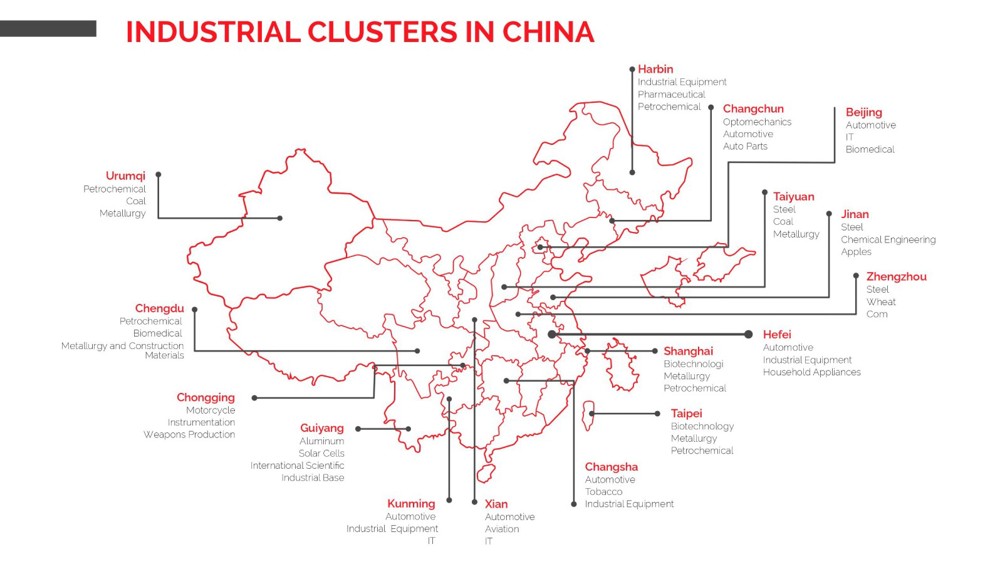

Over decades of industrial scale-up, China has retained its edge in electronics, automotive, machinery, medicals, and other major industries. Its ecosystems, automation, and engineering support remain unmatched.

Advantages of Manufacturing in China

The advantages associated with manufacturing in China include:

- A deep pool of suppliers and a mature manufacturing ecosystem, allowing for rapid scaling and streamlined sourcing across virtually all product categories

- Strong engineering and product development support, allowing companies to innovate quickly, prototype efficiently, and tap into local R&D capabilities

- A high level of automation and vertical integration to further ease the manufacturing process and improve efficiency

Disadvantages

The biggest disadvantages of contract manufacturing in China include US tariffs and geopolitical tension. Rates are currently as high as 50% on some products and the ongoing tariff wars create a high level of uncertainty for the near future.

China’s ongoing political alignment with Russia and increasing tensions over Taiwan also lead to heightened geopolitical strains. This increases operational and reputational risk for companies that rely heavily on Chinese manufacturing.

On top of this, rising wages and an aging population raise concerns over the longevity of China’s contract manufacturing sector.

Finally, there is a perceived IP risk for certain industries, including consumer electronics. Counterfeit products, weak IP enforcement, and limited legal recourse, especially for smaller foreign firms, have heightened the perception of intellectual property vulnerability for companies that source their manufacturing from China. This has led many companies to consider Vietnam as a safer alternative for sensitive operations.

Manufacturing in Vietnam

As the risks of manufacturing in China pile up, Vietnam has managed to position itself as a rising star for global manufacturing. Its trade-friendly environment, youthful labor force, and competitive wages make it an attractive choice, especially for labor-intensive sectors.

Advantages of Manufacturing in Vietnam

The advantages of manufacturing in Vietnam include:

- Despite recent increases, labor costs remain 50 to 70% lower than those In China.

- While also subject to increases, US tariffs imposed on Vietnam have been considerably lower than those on China.

- Vietnam also enjoys favorable tariff agreements with a number of countries, such as the EVFTA (99% of EU tariffs phased out by 2027), CPTPP (duty-free access to Japan, Canada, and Mexico), and the RCEP (the world’s largest Asia-Pacific trade agreement).

- A pro-business government offering numerous incentives to encourage foreign investment in high-tech and export-driven manufacturing.

Disadvantages of Manufacturing in Vietnam

While Vietnam's contract manufacturing presents many advantages, there are also drawbacks to consider.

Vietnamese contract manufacturing has logistical limitations in certain regions, resulting in a shallower supply chain with fewer local suppliers. This also leads to a greater reliance on imports, particularly from China, for key components. As a result, supply chain disruptions in China can affect Vietnamese manufacturing output.

Since its manufacturing sector is still developing, Vietnam also lacks the capacity and equipment for some complex builds, constraining the scalability of high-tech or precision components.

Key Factors to Consider When Choosing Between China and Vietnam

When deciding between contract manufacturing in China and Vietnam, there is no one-size-fits-all answer. The right choice will depend on your company’s particular needs and your willingness and ability to mitigate the risks associated with manufacturing in each country.

Here are the key factors to weigh when comparing these options.

Product Complexity And Component Availability

China excels in high-complexity, high-precision manufacturing. Its vertically integrated supply chains and robust domestic supplier ecosystem allow for seamless component sourcing. This is especially appealing if you deal in electronics, machinery, automotive, or medical devices.

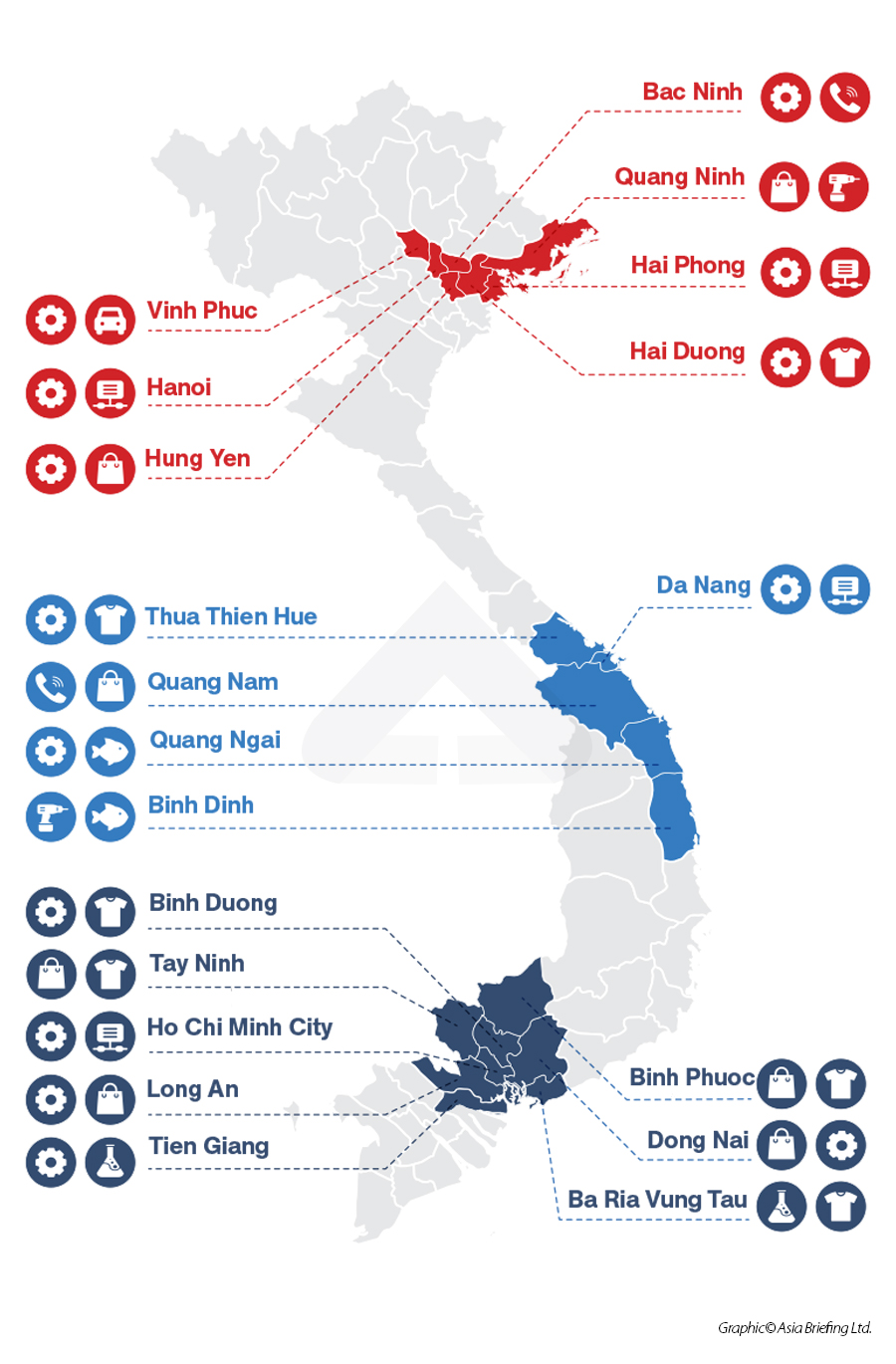

Vietnam is better suited to labor-intensive and lower-tech production, such as garments, furniture, basic electronics, and footwear. While its capabilities in electronics and automotive are growing (especially through Samsung, Intel, and VinFast), contract manufacturing in these sectors still relies heavily on imported components, particularly from China.

Volume, Pricing, and Lead Time Expectations

China remains the leader in large-scale production, capable of fulfilling high-volume orders quickly and with consistent quality.

Vietnam’s more limited capability makes it ideal for small to medium batch production, with low minimum order quantities (MOQs), such as those typical for startups and SMEs. While lead times are generally longer in Vietnam due to its reliance on imported materials and decreased automation, in some cases this is balanced by labor cost savings.

Tariff Exposure and End-Market Location

China faces ongoing tariff pressure, particularly from the United States. Current tariffs are hefty and may be subject to sudden and drastic swings.

Vietnam has weathered the tariff wars more favorably. It also boasts a number of trade agreements that protect exports and limit overall production costs. Overall, this tariff advantage makes Vietnam especially attractive for export-oriented businesses targeting Western markets.

Engineering Support and Customization

China has a wealth of engineering services, tooling, mold design, and product customization, particularly in sectors like consumer electronics. Rapid prototyping and iterative design feedback loops are often faster and more sophisticated in China due to the local expertise and close proximity of suppliers.

Vietnamese manufacturing is still catching up in this regard, especially in the electronics and automotive sectors. While companies like Samsung and Intel do have R&D centers in Vietnam, most domestic manufacturers offer limited in-house engineering support.

Do You Have to Choose Just One? The Case for Dual Sourcing

Of course, there’s no reason to put all your eggs in one basket. Many companies are using a dual-sourcing model that involves contracting with factories in both China and Vietnam to capitalize on each country’s strengths and ensure an optimal production process.

Benefits of a Dual China and Vietnam Strategy

Dual sourcing allows businesses to take advantage of China’s massive scale, advanced infrastructure, and engineering capacity while also benefiting from Vietnam’s lower labor costs, favorable tariffs, and geopolitical neutrality.

In most cases, this involves sourcing components and high-tech assemblies from China while relying on manufacturers in Vietnam for the final product assembly or labor-intensive stages.

For example, an electronics company might source parts in Shenzhen, China, with final device assembly in Bac Ninh, Vietnam. Footwear and apparel brands can source materials and fabrics from China and rely on facilities in Ho Chi Minh City to sew them into garments.

This hybrid model provides efficiency and flexibility in a volatile global market where shipping container shortages, shifting trade policies, and geopolitical tensions can suddenly impact single-country supply chains.

Diversification as a Competitive Advantage

Supply chain diversification isn’t just about risk mitigation; it can also provide a competitive advantage. Companies that distribute production across multiple locations can adapt more quickly to emerging market demands, scale more efficiently, and negotiate better rates.

Vietnam's integration into multiple trade networks offers exporters redundancy and agility when entering key markets, especially in Europe and North America.

When Dual Sourcing Works Best

Dual sourcing works best when products are developed in China but assembled at a lower MOQ in Vietnam. Often, this approach suits growth-stage companies.

High-volume, low-margin products also benefit from dual sourcing by completing labor-intensive stages in Vietnam while leveraging China's automation for component manufacturing to achieve lower total costs.

Conclusion

Deciding between China vs Vietnam for manufacturing isn’t a simple yes or no. It’s highly contextual, and the right choice depends on your product type, market destination, production scale, and risk tolerance.

But broadly speaking, China offers unmatched production capacity, engineering support, and integrated ecosystems, which are perfect for high-tech and high-volume manufacturing.

Vietnam, on the other hand, offers significant advantages in labor costs and tariff rates, making it ideal for export-driven, labor-intensive products.

FAQs

Q: Is Vietnam cheaper than China for manufacturing?

Generally speaking, yes. In terms of labor costs specifically, Vietnam is approximately 30 – 60% cheaper than China. However, logistical challenges, material and component sources, and other considerations can add to the total cost, which could tip the scale in China’s favor.

Q: Which location is better for high-volume production?

China remains the better option for high-volume production due to its scale, automation, and established infrastructure. While Vietnam’s capabilities are improving, it is preferable for low-volume runs and labor intensive production.

Q: Can I source from both countries simultaneously?

Absolutely. In fact, it is often advisable. Many businesses have adopted a dual-sourcing strategies to balance risk, cost, and capacity. This usually involves manufacturing components in China which are then assembled in Vietnam, but the exact dual sourcing strategy depends on the company and product type.

Q: What are the major risks to consider for each?

The major risks of manufacturing in China are its escalating tariffs (especially for US exports), political risks due to its ties to Russia, and concerns over intellectual property protection.

In Vietnam, the major risks are related to its less sophisticated supply chain, less developed infrastructure, and the reduced availability of skilled labor for advanced builds.