A Guide to the Top 25 Contract Manufacturers in Vietnam

- Introduction

- Key Takeaways

- Types of Contract Manufacturers in Vietnam

- Which Type of Manufacturer Should You Use in Vietnam?

- Top EMS & General Contract Manufacturers in Vietnam

- Top CMT Manufacturers in Vietnam

- Top ODM, OEM & Private Label Manufacturers in Vietnam

- Conclusion

Introduction

Vietnam has emerged as a leading destination for global contract manufacturing. They offer affordable and flexible production for a number of different industries. As businesses try to spread out their supply lines and save money, the dynamic and expanding factories make the country an attractive option for manufacturing outsourcing in Vietnam.

This guide gives you the lay of the land in Vietnamese manufacturing, pointing out the main types of Vietnam manufacturers and some of the big players. We'll also touch on crucial factors for choosing the ideal partner: their expertise, production capacity, and overall abilities, to align with your company's requirements. It’s crucial to know these distinctions for forging strong, strategic Vietnam production partners and optimizing your Vietnam supply chain.

Key Takeaways

- Vietnam as a Strategic Alternative: While a strong alternative to China manufacturing, Vietnam has its unique considerations. The market is often less welcoming to smaller customers and brands, the local supply base for complex components (especially electronics) can be limited, and the overall contract manufacturing ecosystem is still maturing.

- Finding the Right Partner Takes Effort: Typical Vietnamese factories don't have the same online visibility as those in other regions. Be prepared for more traditional methods like in-person visits, exhibitions, local agents, or introductions to find the right match.

- Scale and Flexibility are Paramount: Many companies in Vietnam can produce your product, but the right size and flexibility make all the difference. Systematically refine your choices based on the manufacturer's size, type, and specific industry experience.

- Evaluate Capabilities Thoroughly: Take the necessary time to thoroughly evaluate potential Vietnamese manufacturers. Ensure their capabilities and industry experience directly align with your project goals for a successful partnership.

- Data-Driven Insights: This guide provides a short blurb and 1-2 statistics for each industrial sector to give you a clear, fact-based understanding of the market.

- Enhanced Readability: We've used a heavier emphasis on bullet points and shorter, more broken-up paragraphs to significantly increase the article's readability.

Table of Contents

Types of Contract Manufacturers in Vietnam

Before we get into our top contract manufacturers, it is crucial to learn about the various contract manufacturing services available in Vietnam. These models accommodate different client requirements as well as various stages of participation throughout the product development process.

Original Design Manufacturers (ODMs)

Vietnam's ODMs specialize in designing and manufacturing products for which they hold the intellectual property rights. This model allows companies to rebrand these products and bring them to market swiftly.

Key Advantages:

- Rapid Market Entry: Ideal for companies seeking quick access to markets without investing in product design.

- Cost-Effective: Reduces expenses associated with research and development.

- Customization: Offers options for branding and minor design modifications.

Industry Insight:

The ODM model is prevalent in Vietnam's consumer electronics sector, with major players like Samsung and LG establishing significant operations in the country. Samsung, for instance, has invested heavily in Vietnam, contributing over $55.7 billion in export revenue in 2023 alone.

Original Equipment Manufacturers (OEMs)

OEMs in Vietnam manufacture products based on designs provided by client companies, who retain the intellectual property rights. This model is suitable for businesses that require specific product designs and wish to maintain control over their intellectual property.

Key Advantages:

- Design Control: Clients maintain full ownership of product designs.

- Customization: High level of product customization to meet specific requirements.

- Established Supply Chains: Access to Vietnam's robust manufacturing infrastructure and supply networks.

Industry Insight:

Vietnam's OEM sector has attracted significant foreign direct investment, particularly in high-tech industries. In 2024, foreign investment in Vietnam's manufacturing sector reached nearly $26 billion, accounting for 67% of total FDI.

Electronics Manufacturing Services (EMS)

EMS providers in Vietnam offer comprehensive services, including the design, assembly, testing, and distribution of electronic components and products. This sector has seen rapid growth, positioning Vietnam as a key player in the global electronics supply chain.

Key Advantages:

- Comprehensive Services: End-to-end solutions from design to distribution.

- Scalability: Ability to handle high-volume production for various industries.

- Quality Assurance: Adherence to strict quality standards and testing protocols.

Industry Insight:

Vietnam's electronics industry achieved an export turnover of $126.5 billion in 2024, accounting for one-third of the nation's total export value.

Major global brands, including Apple, Samsung, and Intel, have established significant EMS operations in Vietnam, further solidifying the country's position in the electronics manufacturing sector.

Cut-Make-Trim (CMT)

The Cut-Make-Trim (CMT) model is a prevalent garment production method in Vietnam, where brands supply the fabric, trims, and design specifications, and Vietnamese manufacturers handle the cutting, sewing, and finishing processes.

This approach allows brands to maintain control over design while leveraging Vietnam's skilled labor force and efficient production capabilities.

Key Advantages:

- Design Control: Brands retain full authority over design elements and material selection.

- Cost Efficiency: By outsourcing labor-intensive processes, companies can reduce production costs.

- Scalability: Vietnam's manufacturing infrastructure supports both small-scale and large-volume orders.

Industry Insight:

- In 2024, Vietnam's textile and garment exports reached USD 44 billion, marking an 11.2% year-on-year.

- The United States remained the largest export market, accounting for approximately 38% of total exports, followed by Japan, the EU, South Korea, and China.

- CMT operations constitute a significant portion of Vietnam's garment manufacturing sector, highlighting the country's role as a key player in the global apparel supply chain

Which Type of Manufacturer Should You Use in Vietnam?

Selecting a contract manufacturing model in Vietnam requires a careful assessment of product needs together with desired design control levels and budget constraints.

- ODMs: Companies aiming for economical market entry with standard or slightly modified products which do not require standout designs should opt for ODM Vietnam companies.

- OEMs: : These are perfect when you have your own proprietary product designs and need a manufacturer with specific expertise and established supply chains to bring your vision to life. OEMs are crucial for product sourcing in Vietnam when design control is paramount.

- EMS providers: They stand out as the preferred choice for electronics sector companies that require specialized electronics manufacturing Vietnam services which include both component assembly and complete product manufacturing.

- CMT: CMT Vietnam manufacturers are best for apparel production and footwear manufacturer companies that want to leverage Vietnam's strong capabilities in these sectors while maintaining control over design and materials. This includes contract garment manufacturers in Vietnam and contract manufacturing for footwear in Vietnam.

| Model | Design Ownership | Customization Level | Ideal For | Key Benefits |

|---|---|---|---|---|

| Original Design Manufacturer (ODM) | Manufacturer | Low | Quick market entry with standard products | Cost-effective; minimal design input required |

| Original Equipment Manufacturer (OEM) | Client | High | Companies with proprietary designs seeking manufacturing | Full control over product design and specifications |

| Electronics Manufacturing Services (EMS) | Client | High | Electronics firms needing component assembly and testing | Expertise in electronics; scalable production |

| Cut-Make-Trim (CMT) | Client | High | Apparel and footwear brands supplying materials and designs | Cost-effective labor; control over materials and design |

| Private Label Manufacturer | Manufacturer | Moderate | Retailers wanting branded generic products | Quick market entry; branding without design responsibilities |

Evaluating your specific needs and comparing them against the strengths and specializations of different Vietnam manufacturing companies will guide you towards the most suitable partnership. This is a crucial step in how to choose a contract manufacturer in Vietnam.

Top EMS & General Contract Manufacturers in Vietnam

Tier 1 (Largest Global or National Scale)

1. Foxconn

Foxconn is a leading EMS Vietnam provider assembling Apple and other electronics. It operates major facilities in Bac Giang and Bac Ninh provinces.

These factories help anchor Vietnam’s growing electronics manufacturing Vietnam sector.

Foxconn plays a central role in global electronics supply chains and is one of the top OEM manufacturers in Vietnam 2025.

2. Flex Ltd.

Flex Ltd., headquartered in Singapore, is one of the largest EMS providers globally and operates major manufacturing facilities in Vietnam.

Their operations cover sectors such as medical devices, automotive systems, and networking equipment. Flex has positioned itself as a strategic player in Vietnam's electronics supply chain, supporting both high-volume and high-complexity builds for global clients.

3. Accton Technology Corporation

Accton Technology Corporation, a Taiwanese networking equipment manufacturer, has invested heavily in a plant in Vĩnh Phúc province.

Their Vietnam facility is a key production site for broadband and communication hardware for global clients such as Amazon and Hewlett Packard Enterprise. Accton’s role in Vietnam illustrates the country’s rising profile in telecommunications electronics manufacturing.

Tier 2 (Large Regional Players, Focused Industries)

1. Sunching Electronics Vietnam

Sunching Electronics Vietnam operates out of Binh Duong province and specializes in PCB assembly across various formats, including single-sided, double-sided, and multilayered designs.

The company supports a diverse client base that includes Canon, Nidec, and Omron, underscoring its technical capabilities and established role in Vietnam’s component supply ecosystem.

2. Fab 9

Fab 9, also based in Binh Duong, offers integrated EMS services such as PCB fabrication, assembly, and mechanical box building.

With a strong engineering background, Fab 9 serves technology-focused clients like Vishay and Thermo Fisher Scientific, providing a full range of build-to-spec electronics manufacturing.

Tier 3 (Smaller Scale, Regional Focus, Niche Production)

1. Komaspec

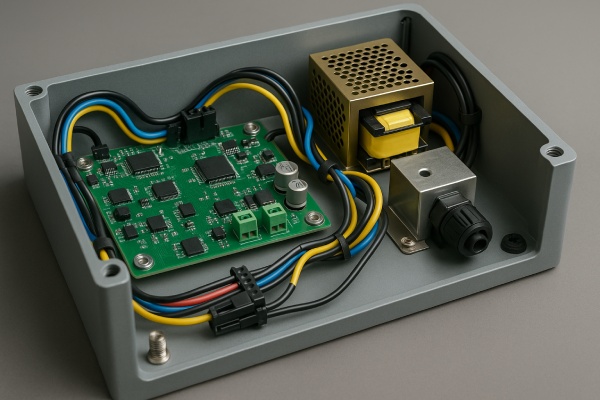

Komaspec excels in precision manufacturing, producing sheet metal, plastic, and electro-mechanical products. They offer comprehensive turnkey product assembly services as a contract manufacturer.

Their full suite of services spans from design for manufacturability (DFM) support and prototyping to pilot productions, thorough quality reports, and all necessary assistance to ramp up to mass production. Find out more about Komaspec here.

2. Fuhong

Fuhong specializes in precision components for global electronics manufacturers in Vietnam. Operating in Bac Giang, it serves niche needs within the electronics supply chain.

3. Funing

Funing produces electronic components with a focus on precision and regional customers. It operates at a smaller scale compared to Tier 1 giants but plays a vital role in component supply for electronics manufacturing Vietnam.

Top CMT Manufacturers in Vietnam

Tier 1 (Largest Global or National Scale)

1. Vinatex

Vinatex is Vietnam’s largest textile and garment group overall, operating broadly in Hanoi, Ho Chi Minh City, and across 22 subsidiaries nationwide. The group controls a complete supply chain, from raw materials to finished garments.

In 2023, Vinatex reported revenue of VND 14.9 trillion (approximately USD 628 million), despite challenges from reduced global demand. The group employs over 80,000 workers and exports to more than 66 countries.

Its strategic role in Vietnam’s textile economy is reinforced by continued investment in digital transformation and sustainable production.

2. Pou Chen Group

Pou Chen is a globally dominant footwear manufacturer and one of Vietnam’s largest employers. As of 2024, the company employs over 140,000 workers across facilities in Dong Nai, Tien Giang, and other provinces.

Pou Chen manufactures footwear for international giants like Nike, Adidas, and Asics. The group’s Vietnam-based operations account for roughly 44% of its global production output. In 2023, Pou Chen produced over 300 million pairs of shoes globally, a significant share of which originated from Vietnam.

Tier 2 (Large Regional Players, Focused Industries)

1. TAL Apparel

TAL Apparel in Dong Nai focuses on producing high-quality apparel production in Vietnam for global brands.

It operates on a large regional scale, with strong quality control but a narrower geographic footprint compared to Tier 1 giants, making them a top Vietnam garment manufacturer.

2. Esquel Group

Esquel is known for high-quality cotton shirts and operates mainly in Ho Chi Minh City. It caters to premium global brands, emphasizing craftsmanship and sustainable practices within a regional scale, making them a key Vietnam textile manufacturer.

Tier 3 (Smaller Scale, Regional Focus, Niche Production)

1. Thygesen Textile

Thygesen Textile in Hanoi specializes in protective clothing and children’s underwear. It operates on a smaller scale with niche products for local and regional markets, demonstrating a focus on specific apparel production Vietnam.

2. G & G II

G & G II produces sports clothing, jackets, and dresses in Dong Nai. It focuses on regional niche apparel production Vietnam.

Top ODM, OEM & Private Label Manufacturers in Vietnam

Food Packaging and Processing

1. Vinamilk (Vinh Phuc)

Vinamilk is Vietnam’s leading dairy producer known for many products. They make milk, yogurt, cheese, and other quality dairy items. The company is well known for innovation and quality control.

In 2024, Vinamilk achieved a record annual net revenue of VND61.78 trillion ($2.46 billion), up 2.3% from 2023. The domestic market contributed VND50.79 trillion ($2.03 billion), while revenue from foreign markets surged 12.6% to VND10.98 trillion ($437.9 million), the highest in five years.

Serving both domestic and international markets, they have broad distribution channels. Vinamilk also offers private label manufacturing for various clients in food processing in Vietnam.

2. Nestlé Vietnam (Dong Nai, Binh An, Hung Yen)

Nestlé Vietnam is part of the global Nestlé group producing many foods. They manufacture coffee, dairy, snacks, and various other beverage products. Their large plants support branded and private label production in Vietnam for export.

The company serves both domestic consumption and international markets efficiently, excelling in food processing in Vietnam.

In 2024, Nestlé Vietnam announced an investment of nearly VND1.9 trillion ($73.4 million) to expand its Tri An factory in Dong Nai province, one of the group's most advanced coffee processing plants worldwide. This expansion is part of Nestlé Vietnam's total accumulated investment in the country, which has risen to nearly VND20.2 trillion.

3. Minh Phu Seafood JSC (Ca Mau)

Minh Phu is a top seafood exporter and processor in Vietnam, specializing in shrimp and other seafood products. The company maintains strict quality standards and targets demanding export markets.

In 2024, Minh Phu Seafood estimated revenues of $773.33 million and profit after tax of $52.5 million. The company's export volume grew by about 20% year-on-year, despite challenges such as a shortage of raw shrimp materials and rising logistics costs.

Chemicals and Plastics

1. BASF Vietnam (Bac Giang Province)

BASF is a global chemical leader producing diverse products for industries. They serve agriculture, automotive, construction, and other major sectors. In Vietnam, BASF supplies raw materials for OEM manufacturers. The company focuses on innovation and sustainable chemical solutions locally.

2. Dow Chemical (Multiple locations)

Dow Chemical produces acrylic polymers and specialty chemicals for many sectors. Their products are used in plastics, coatings, adhesives, and more. Vietnam facilities act as key suppliers for OEM manufacturers needing polymers. They provide advanced solutions to support multiple industries locally.

3. Vinachem (Hanoi, Ho Chi Minh City, Phu Tho)

Vinachem, Vietnam's leading fertilizer and chemical producer, reported a consolidated profit of VND 6,023 billion (approximately $256.8 million) in 2022, marking a 2.8-fold increase year-on-year and setting a record high. The company's revenue was estimated at VND 62.262 trillion ($2.65 billion), exceeding its plan by 19% and up 17% year-on-year. In the first five months of 2025, Vietnam's fertilizer exports reached 281,208 tonnes, worth $100.64 million, with Cambodia leading the list of export markets.

Furniture Manufacturing

Vietnam's furniture industry is predominantly concentrated in the southern region, particularly in provinces like Binh Duong and Dong Nai. The country has become the second-largest furniture exporter globally, with exports growing from $5 billion to nearly $20 billion over the past decade. In 2024, the wood processing and furniture industry achieved over $8 billion in exports, reaching more than 140 countries, with over 80% of those exports shipped to North America, Japan, Korea, and the EU.

1. Scansia Pacific

Established in 2001, Scansia Pacific specializes in producing Scandinavian-inspired indoor and outdoor furniture.

The company operates five factories in Vietnam and additional facilities in Myanmar, Indonesia, and Cambodia, employing over 1,000 workers. Scansia Pacific supplies to renowned global retailers such as IKEA, Walmart, and John Lewis.

2. Truong Thanh Furniture

Truong Thanh Furniture Corporation is a major exporter of wooden furniture products, including tables, chairs, and other items made from wood.

The company primarily exports to Europe and North American markets. As of March 2022, Truong Thanh Furniture Corporation had 4,231 customs import and export records, with 82 importers and 144 suppliers included in trade data.

Automotive Manufacturing

Vietnam's automotive manufacturing industry is dominated by international OEMs, particularly Japanese and Korean firms. However, there is a growing domestic sector of parts and assembly providers, led by the THACO Group.

In 2024, Vietnam's domestic car production was estimated at 388,500 units, marking a 27% increase compared to 2023. The supply chain for the industry is primarily clustered in northern Vietnam around Hanoi, but as the sector grows, other regional players are emerging in different regions.

1. Toyota Vietnam

Toyota Vietnam operates a manufacturing plant in Vinh Phuc province, established in 1995. As of 2025, the plant has produced over 700,000 vehicles, with an annual production capacity of approximately 27,000 units.

The facility assembles popular models such as the Toyota Vios, Innova, and Fortuner. Toyota Vietnam employs about 2,000 people and has been a significant contributor to the country's automotive industry.

You can view an interactive map with OEM Plants in Vietnam here.

2. THACO (Trường Hải Auto Corporation)

THACO is Vietnam’s largest automotive manufacturer producing various vehicle types. It assembles cars, trucks, and buses under Kia and Mazda brands. THACO has also developed the homegrown VinFast brand to support export growth.

The company is the primary driver behind Vietnam’s growing domestic automotive sector and has spun out the THACO Industries, which is a supplier of complex components (injection, glass, wire harnessing, trailers, etc.) to both its parent companies and international OEMs.

3. Hyundai Vietnam

Hyundai Vietnam, through its joint venture with Thanh Cong Group, operates two manufacturing plants in Ninh Binh province. The combined annual production capacity of these facilities is projected to reach 180,000 vehicles by 2025.

In 2023, Hyundai produced approximately 43,800 vehicles in Vietnam. The company manufactures various models, including the Accent, Elantra, and Santa Fe, catering to both domestic and export markets.

4. Denso Vietnam

Denso Vietnam is a major automotive parts supplier specializing in a range of components. Their products include spark plugs, horns, wiper blades, oil filters, car and bus air conditioning systems, and diesel fuel injection products.

Denso's operations in Vietnam serve both original equipment manufacturers and the aftermarket, ensuring high-quality components for the automotive sector.

Conclusion

Vietnam’s contract manufacturing sector offers a wide range of options for businesses seeking cost-effective, high-quality production. Whether you need large-scale electronics manufacturing, custom apparel, or private label goods, Vietnam provides flexible models like OEM, ODM, EMS, CMT, and private label production.

Choosing the right partner depends on your product complexity, desired control over design, and production volume. Small manufacturers are ideal for specialized or low-MOQ projects, while larger firms handle high-volume, complex operations. By understanding Vietnam’s manufacturing landscape and aligning it with your business needs, you can build a reliable supply chain and scale efficiently.

Komaspec is a Canadian-owned contract manufacturer with over 20 years of experience helping companies scale production. With facilities in China, Vietnam, and Mexico, we offer turnkey manufacturing solutions tailored to your needs—from prototyping to mass production.