A Guide to Contract Manufacturing in Vietnam

- Introduction

- Key Takeaways

- Why Choose Vietnam for Contract Manufacturing

- Factors to Consider Before Outsourcing to Vietnam

- Steps to Take Before Reaching Out to Manufacturers

- Types of Contract Manufacturers in Vietnam

- How to Find a Contract Manufacturer in Vietnam

- Vietnam’s Manufacturing Geography

- How to Choose the Right Contract Manufacturer in Vietnam

- Final Recommendations

- FAQs

Introduction

Vietnam has rapidly recently emerged as a contract manufacturing powerhouse, especially for companies seeking supply chain diversification beyond China.

With rising costs and geopolitical uncertainties in traditional manufacturing hubs, Vietnam has managed to stand out as a strategic, cost-effective alternative. In 2025, it offers competitive labor costs, modern infrastructure, and trade accessibility for global OEMs and brands.

Key Takeaways

- Vietnam offers major advantages for contract manufacturing, including labor costs, infrastructure, and favorable trade agreements.

- Vietnam is ideal for high-mix, medium-volume production, especially in electronics, plastics, textiles, and metal fabrication.

- Succeeding in Vietnam requires thorough preparation and due diligence, including product specs, clear target costs, and well-defined compliance requirements.

- Not all Vietnam manufacturers are created equal and vary in engineering support, quality control systems, and ability to scale.

- Vietnam’s diverse manufacturing hubs offer unique strategic advantages, including port access, local supply chains, and skilled talent.

Table of Contents

- Introduction

- Key Takeaways

- Why Choose Vietnam for Contract Manufacturing

- Factors to Consider Before Outsourcing to Vietnam

- Steps to Take Before Reaching Out to Manufacturers

- Types of Contract Manufacturers in Vietnam

- How to Find a Contract Manufacturer in Vietnam

- Vietnam’s Manufacturing Geography

- How to Choose the Right Contract Manufacturer in Vietnam

- Final Recommendations

- FAQs

Why Choose Vietnam for Contract Manufacturing?

In recent years, Vietnam has firmly established itself as a competitive and reliable destination for contract manufacturing, particularly for companies seeking to diversify away from China.

While it's not a one-size-fits-all solution, contract manufacturing in Vietnam offers several compelling advantages that make it a prime choice for global supply chains in 2025.

Cost Competitive (But the Gap with China Is Narrowing)

Vietnam’s labor costs remain lower than China’s, with the average monthly wage for manufacturing workers hovering around $261 (compared to approximately $689 in China). This wage differential translates into tangible savings, especially for labor-intensive production.

However, while this gap is wide, it is narrowing. Wages and land costs are gradually increasing as Vietnam’s economy develops.

Still, this is only part of the picture. Businesses should consider total landed cost, including component sourcing, logistics, lead times, and quality costs, not just labor rates, when comparing Vietnam to China.

Tariff Relief and Trade Agreements

Vietnam is one of the most open economies in Asia, benefiting from a wide range of free trade agreements (FTAs) that provide tariff reductions and preferential access to key markets. These include:

- EU-Vietnam Free Trade Agreement (EVFTA) – Eliminates 99% of tariffs between Vietnam and the EU.

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) – Covers major economies including Japan, Canada, and Australia.

- ASEAN Free Trade Area (AFTA) – Streamlines trade with neighboring Southeast Asian nations.

- Currently, tariff rates with the US stand at 25% – which is one of the lower rates in South East Asia.

These agreements help offset shipping costs and duties, especially compared to regions without similar trade coverage.

Young Labor Force and a Stable Political Environment

Vietnam’s population of nearly 100 million people is young, tech-savvy, and increasingly skilled. Over 70% are under the age of 40, and the government continues to invest in vocational training and STEM education to build industrial capabilities.

In recent history, Vietnam has also been one of the most politically stable countries in Asia. Moreover, the government has consistently delivered pro-business policies, industrial zone incentives, and a centralized push to develop the manufacturing sector.

Diversification Benefits for Global Supply Chains

The “China + 1” strategy, where businesses maintain production in China but diversify to another country, has made Vietnam a top choice for a second locale. This is due to its:

- Easy access to Chinese supply chains (by truck or short container shipment) for key components such as: electronic components, custom motors, displays, textile materials, etc.

- Similar time zone to key sourcing hubs in East Asia

- Strong port access and multiple international gateways

- Growing ecosystem of local and foreign-owned factories

For brands and OEMs seeking flexibility, contract manufacturing in Vietnam provides a hedge against trade volatility, labor risk, and overreliance on one geographical area.

Factors to Consider Before Outsourcing to Vietnam

The advantages of contract manufacturing in Vietnam are undeniable, but success requires an understanding of the nuances in the country’s ecosystem. Even with favorable costs and trade agreements, not every product or business model will thrive here.

Let’s look at some of the factors that should guide your outsourcing strategy.

Labor Cost vs. Technical Capability

Vietnam offers substantial labor savings for assembly-heavy and labor-intensive products. As of 2025, the average monthly manufacturing wage in Vietnam is about $300 lower than it is in China, making it an attractive option for cost-sensitive projects.

However, technical sophistication varies across regions and factory types.

While manual assembly, sheet metal fabrication, and plastic injection molding are areas of strength (especially in hubs like Hai Phong and Binh Duong), for more complex processes like semiconductor fabrication, precision CNC machining (under ±0.005 mm tolerance), or automation-based robotics assembly Vietnam still trails behind China, Taiwan, and Korea.

Supply Chain Depth and Component Availability

Vietnam’s supply chains are growing but are not yet as mature as China’s.

This creates a number of challenges for manufacturing, including:

- Limited availability of raw materials like aluminum billets, specialty resins, and electronics components.

- Heavy dependence on imports for key inputs (e.g., 80–90% of cotton for textiles is imported).

- Fewer Tier 2 and Tier 3 local suppliers for high-spec parts.

What Type of Production Works Well in Vietnam

Vietnam excels in:

- Sheet metal fabrication

- Plastic injection molding

- Pipe and tube processing

- Consumer goods assembly

- Textiles and garment production

It’s also increasingly competent in simple to mid-level electronics, especially in the north (Hai Phong, Bac Ninh). However, products requiring multi-layer PCB design, tight machining tolerances, or complex system integration may require consignment or importation of components and boards from China, Taiwan or other regions.

Logistics: Port Access, Inland Transport, and Customs

Vietnam has a strong network of deepwater ports, including:

- Hai Phong (North)

- Da Nang (Central)

- Cat Lai, Cai Mep-Thi Vai (South)

However, its inland infrastructure, such as roads and rail, can be less reliable, especially in rural provinces. Only 20% of national roads are paved, and port congestion remains a challenge during peak trade seasons.

When selecting a contract manufacturer, make sure they are located in well-connected industrial zones with easy access to major ports.

Communication and Cultural Differences

English proficiency among factory staff is improving, but:

- Daily communication may still require translation or bilingual staff.

- Time zone coordination and workweek differences can impact response time.

- Misunderstandings in specifications or tolerances are common without rigorous documentation.

Western-managed firms can bridge this gap with bilingual project managers and real-time production tracking for customers.

Steps to Take Before Reaching Out to Manufacturers

Getting the best results with Vietnamese contract manufacturing starts long before you engage a factory. Diligent preparation can reduce miscommunication, prevent costly delays, and help you identify qualified partners more efficiently.

Whether you’re a startup or an experienced OEM, here are some steps you should take before requesting quotes.

Solidify Product Specifications, BOM, and Drawings

Unclear specifications are one of the most common points of failure in outsourcing.

Before you approach a manufacturer, make sure you have:

- Detailed engineering drawings (preferably 2D + 3D CAD)

- A complete bill of materials (BOM) with reference part numbers

- Material and surface finish requirements

- Assembly instructions and quality standards

This clear documentation reduces needless back-and-forth, helps avoid bad samples, and sets the foundation for transparent pricing.

Understand Testing and Compliance Requirements

Contract manufacturing in Vietnam often relies on the buyer to define compliance needs.

That means it’s your responsibility to specify:

- Product safety or industry certifications (e.g., CE, FCC, RoHS)

- Specific test protocols (e.g., drop tests, IP ratings)

- Functional testing requirements or tolerances

- Documentation for export or customs clearance

If you're shipping into markets like the EU or US, you must consider testing and labeling standards from day one, not after sampling.

Define Target Cost, MOQ, and Production Scale

Be upfront about your business goals.

When quoting, manufacturers will want to know:

- Your target cost per unit and acceptable tolerances

- Estimated minimum order quantity (MOQ)

- Potential for scaling volume over time

Many factories in Vietnam are open to low-to-mid MOQs, such as 250–500 pcs, for first orders. This is quite reasonable compared to the typical 1,000+ unit requirements set by Chinese factories. However, lead times and costs are heavily influenced by batch size, so clarity helps align expectations.

Get Clear on Contract Manufacturing vs. OEM/ODM

Before engaging factories, define your sourcing model:

- Contract Manufacturing (CM): You provide the design; the factory builds to spec.

- Original Equipment Manufacturer (OEM): Factory provides partially developed designs that you customize.

- Original Design Manufacturer (ODM): Factory owns the product intellectual property (IP) and design entirely.

Vietnamese manufacturers range across all three, so be sure to communicate whether you're looking for build-to-print services or design support.

Once you’re equipped with documentation and clarity, the next step is understanding the types of contract manufacturers available to you and which ones are best aligned with your business goals.

Types of Contract Manufacturers in Vietnam

Contract manufacturing in Vietnam is diverse, ranging from small family-run workshops to sophisticated, Western-managed factories with global clients.

Understanding the different types of contract manufacturers operating in Vietnam is crucial to selecting the right partner for your product type, budget, and expectations.

Vietnamese-Owned SMEs

Vietnamese small and medium enterprises (SMEs) make up a large portion of the local manufacturing landscape.

These factories typically offer:

- Lower labor and operational costs

- Flexible MOQs for simple assemblies or textiles

- Skilled manual processes like sewing, welding, or basic assembly

However, challenges include:

- Limited English proficiency

- Less formalized processes or documentation

- Variability in quality control (unless externally audited)

Vietnamese SMEs are a good fit for low-complexity, high-labor products, especially in textiles, home goods, and hand assembly.

Asian EMS & CMs Factories

Many established manufacturers from China, Taiwan, South Korea, and Japan have set up operations in Vietnam to offset rising costs and diversify supply chains.

These factories often bring:

- Proven processes and established tooling systems

- Skilled supervisors and engineers from their home countries

- Greater experience with consumer electronics, automotive parts, or metalwork

However, some foreign-owned firms remain opaque or difficult to work with unless you speak the local language or engage a sourcing agent.

Generally, these firms are focused on OEM/ODM business, and often supply large brands or higher tier contract manufacturers. They are not always the best choice for companies with smaller or more flexible needs.

Western-Managed Contract Manufacturers

Western-managed CMs combine on-the-ground manufacturing in Vietnam with the transparency, responsiveness, and engineering rigor Western buyers expect.

Benefits include:

- Rigorous project management systems

- End-to-end support (from DFM to QA to logistics)

- Greater accessibility for small to mid-sized businesses

- Extensive experience working with Western firms and products meant for those markets

How to Find a Contract Manufacturer in Vietnam

Finding a reliable contract manufacturer in Vietnam requires more than just a quick Google search. While some factories have a strong digital presence, many still rely on offline channels like trade shows and personal introductions.

To build a successful partnership, you need to know where to look and how to carefully vet potential partners.

Online Directories and Sourcing Platforms

Popular sourcing websites like Alibaba, Global Sources, and Vietnam Manufacturers Directory list Vietnamese suppliers. However, many of them have incomplete profiles and do not verify the manufacturers’ capabilities.

These platforms are best used for:

- Preliminary research

- Gathering benchmark quotes

- Cross-checking suppliers you meet through other channels

Be cautious of middlemen or trading companies posing as direct manufacturers, especially on large online platforms.

Trade Shows and Industrial Networks

Attending local trade shows may seem old fashioned, but it’s one of the most effective ways to connect with vetted Vietnamese manufacturers.

Major events include:

- Vietnam Manufacturing Expo (Hanoi)

- Global Sourcing Fair Vietnam (Ho Chi Minh City)

- Vietnam Industrial and Manufacturing Fair (VIMF)

Attending these will give you the opportunity to meet suppliers in person, inspect sample products, and assess how manufacturers present themselves professionally.

Sourcing Agents or Third-Party Consultants

Hiring a local sourcing agent or consultancy can help bridge cultural gaps, verify factories, and manage supplier relationships.

A good agent will:

- Pre-vet potential manufacturers

- Handle site visits and audits

- Help manage compliance and logistics

- Serve as your eyes and ears on the ground

However, agents vary in reliability. Always check their references and fee structures.

Due Diligence and Common Red Flags

Before committing to a manufacturer, conduct thorough due diligence.

Ask questions like:

- Can they provide recent customer references?

- Are factory certifications (e.g., ISO 9001, CE, RoHS) up to date?

- What quality control and traceability systems are in place?

- Do they allow factory visits or remote video tours?

Watch for warning signs, like:

- Overpromising on capabilities or timelines

- Reluctance to share ownership or export license info

- Operations without a fixed business address or verifiable contact

- Pushy behavior to get deposits without a technical discussion

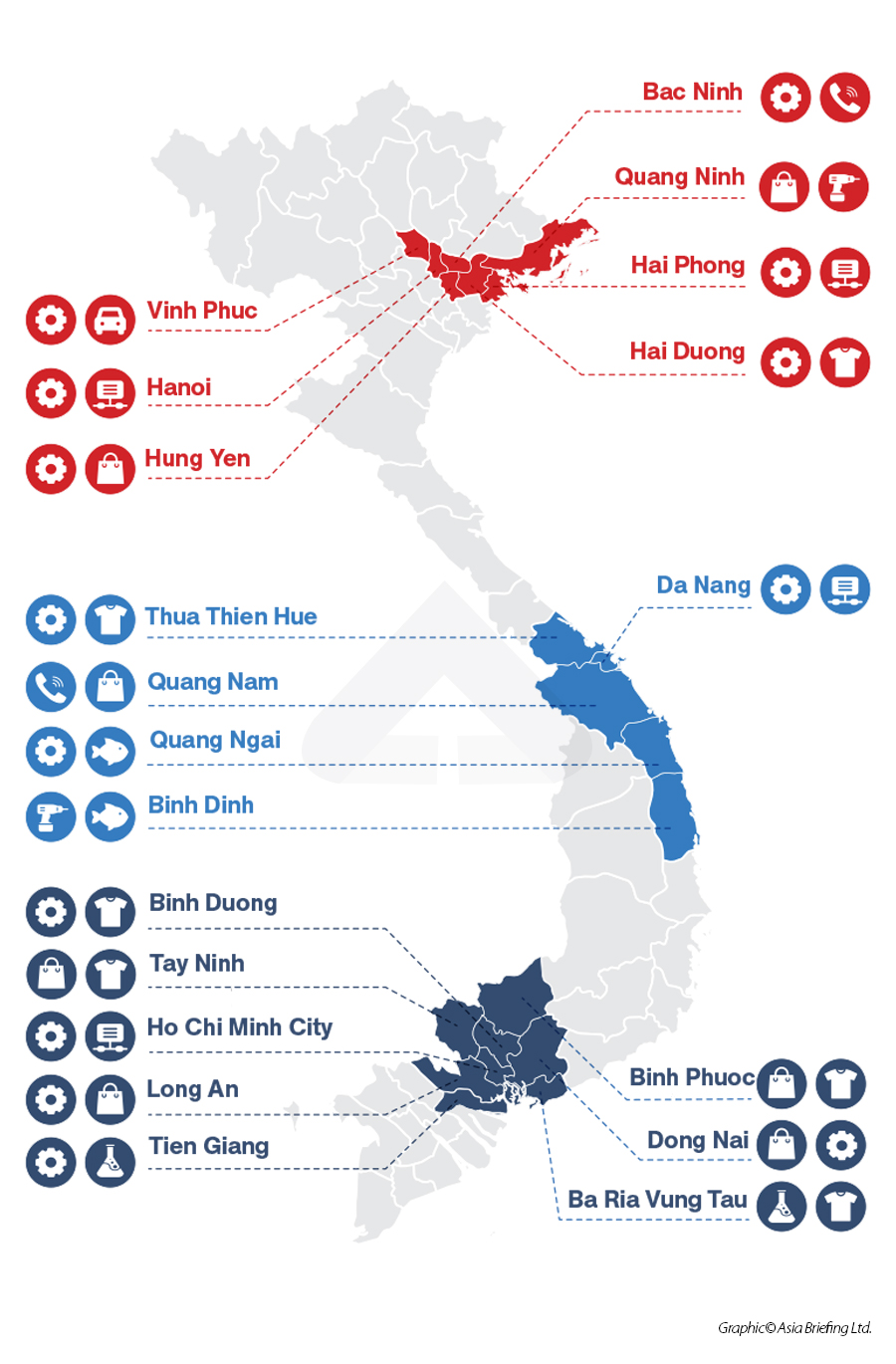

Vietnam’s Manufacturing Geography

Another important consideration is the location of your potential Vietnam contract manufacturing partner. Different regions of the country specialize in specific types of manufacturing, based on the local infrastructure, available workforce, and historical foreign investment.

Understanding Vietnam’s manufacturing geography will help you choose suppliers that align with your product needs and logistics strategy.

North Vietnam (Hanoi, Bac Ninh, Hai Phong)

The north is Vietnam’s primary hub for electronics manufacturing, electromechanical assembly, and export processing zones.

Benefits of working with manufacturers in this region include:

- Proximity to China, enabling easy access to components and raw materials

- Well-developed ports (like Hai Phong, which handled over 190 million metric tons of cargo in 2024) and expressways for export logistics.

- Strong presence of foreign-invested enterprises like LG, Foxconn, and Samsung (which has invested over $23.2 billion in its Vietnamese operations, mostly in the country’s northern region).

North Vietnam is ideal for assembly-heavy products, electronics, and multi-component builds that require tight supply chain integration.

Central Vietnam (Da Nang, Quang Nam, Hue)

Central Vietnam is still developing industrially but gaining traction due to:

- Lower labor costs, with wages in central provinces like Da Nang and Quang Nam sitting approximately 10–15% lower than those in the industrialized northern or southern zones.

- Emerging industrial parks like the Da Nang Hi-Tech Park and Chu Lai Open Economic Zone, which have drawn increased foreign and domestic investment.

- Proactive government incentives, such as tax breaks, land lease discounts, and streamlined licensing processes.

The central region is a good fit for companies looking for cost-effective manufacturing in early stages (especially for simpler assemblies) or those wishing to expand outside the more saturated zones.

South Vietnam (Ho Chi Minh City, Binh Duong, Dong Nai)

The south of Vietnam remains the country’s most diverse and industrially mature region.

Some of its advantages include:

- Sector diversity, with the south serving as a hub for textiles, garments, plastic injection molding, footwear, and packaging, as well as high-volume consumer goods across both domestic and export markets.

- Robust logistics infrastructure, withHCMC’s Ho Chi Minh City’s Tan Son Nhat International Airport and major ports such as Cat Lai (which handles over 5 million TEUs annually) to support high throughput and international trade.

- Dense supplier ecosystems, with long-established industrial zones like VSIP, Amata, and Long Duc offering mature ecosystems and quick access to tooling, components, and third-party services.

However, these benefits come at a premium. Labor costs in HCMCHo Chi Minh City are among the highest in Vietnam, often exceeding $350/month for factory workers, and the region faces chronic congestion and rising overheads.

Still, for volume-driven production and brands prioritizing speed-to-market and supply chain density, South Vietnam is a compelling option.

Regional Infrastructure Differences and Logistics Considerations

| Region | Specialties | Infrastructure Notes |

|---|---|---|

| North | • Electronics • Complex assemblies |

• Ports • Highways • Easy access to China |

| Central | • Cost-effective labor • Simpler manufacturing |

• Still developing • Fewer suppliers |

| South | • Textiles • Plastics • Packaging |

• Mature ecosystem • Better logistics • Higher costs |

How to Choose the Right Contract Manufacturer in Vietnam

Selecting a contract manufacturing company in Vietnam involves more than just finding a factory that will produce your part. You should also be seeking a long-term partner who understands your quality standards, communication preferences, and growth plans.

Here’s how to assess potential suppliers with a sharp, systematic lens.

Evaluate Capabilities and Specialization

Not all manufacturers are equipped to handle every product type.

When considering a manufacturer, be sure to assess the following:

- Production capabilities: Can they handle complex assemblies or multi-material components? Do they have the extra capacity to produce your products with a reasonable lead time?

- Manufacturing process coverage: Do they offer in-house stamping, injection molding, laser cutting?

- Volume alignment: Are they optimized for high-mix/low-volume, or high-volume runs? Will they want to do the volumes you need?

Check Quality Control Processes and Certifications

Quality must be consistent and auditable:

- Are there documented QC procedures and inspection checkpoints?

- Do they use digital platforms for real-time quality visibility?

- Can they meet your compliance or certification needs?

Assess Communication and Culture

Communication breakdowns lead to production delays, cost overruns, and frustration.

Avoid these by considering the manufacturer’s:

- English fluency and the responsiveness of the account team

- Project management structure (dedicated manager? escalation path?)

- Experience with Western communication norms (such as proactive updates, timelines, and accountability)

Ethical Standards and ESG Concerns

With growing pressure on global brands to ensure ethical sourcing, make sure your manufacturer aligns with your values:

- Labor standards: Are wages and working conditions documented and fair?

- Environmental practices: Do they follow local laws and take steps to minimize waste?

- Certifications: Are they in compliance with ISO 14001? Do they participate in any ESG or sustainability programs?

Vietnam’s ESG standards are still maturing, but some manufacturers are leading the way, especially those targeting international OEM clients.

Scaling Capacity and Flexibility

Your ideal manufacturing partner should grow with you.

Avoid future complications by asking:

- Can they ramp from pilot to full production without disruption?

- Do they have the space, workforce, and systems to scale throughput?

- How do they handle multi-SKU production?

Final Recommendations

Vietnam is now firmly established as a strategic location for contract manufacturing. With its maturing infrastructure, competitive labor costs, favorable trade agreements, and growing capacity for complex assembly work, contract manufacturing in Vietnam presents a compelling opportunity for brands seeking agile, cost-effective, and scalable manufacturing solutions.

However, benefiting from this arrangement depends heavily on preparation, careful partner selection, and a clear understanding of the local landscape.

Checklist: How to Begin Working With a Vietnamese Manufacturer

Before committing, make sure your internal team and potential supplier are aligned on:

- 1. Product specifications, BOM, target cost, and compliance requirements

- 2. Your preferred manufacturing model (contract manufacturing, OEM, or ODM)

- 3. Quality expectations and inspection protocols

- 4. Required certifications and sustainability standards

- 5. Communication methods and escalation paths

- 6. Pilot run and scaling roadmap

- 7. Payment terms, IP protection, and legal safeguards

When Vietnam Is the Right Fit (And When It Might Not Be)

Vietnam may be a great fit if you:

- Need medium-volume, high-mix production with strong cost control

- Want to diversify from China under a “China + 1” strategy

- Require assembly-heavy processes or electromechanical integration

- Value regions with robust free trade agreements

It may not be ideal if you:

- Require very high-volume runs and hyper-specialized local supply chains

- Need ultra-low MOQs for experimental products (some SMEs can do this, but many cannot)

- Are building products requiring proprietary materials not readily sourced in Vietnam

Get the Most Out of Contract Manufacturing with Komaspec

Komaspec’s facility in Hai Phong reflects the best that Vietnam contract manufacturing has to offer. With experience supporting over 100 brands across industries, Komaspec offers:

- Turnkey contract manufacturing with DFM, prototyping, NPI, and scaling

- Access to both China and Vietnam supply and production bases.

- Western account management and communication practices

Looking for a reliable contract manufacturing partner in Vietnam? Schedule a call or get a quote today.

FAQs: Contract Manufacturing in Vietnam

Can I fully shift production from China to Vietnam?

In many cases, yes, but it depends on your supply chain. Vietnam excels in labor-intensive assembly and medium-complexity builds, but still imports many raw materials and specialized components from China.

A full shift may be feasible if your BOM and quality needs align with local capabilities, especially in fabricated good with simpler inputs that don’t involve many parts, such as textiles, sneakers, clothes and household goods.

For more complex products and electronics, a hybrid “China + Vietnam” model is often the most efficient path. With this approach, some components or sub-assemblies are built in China, with final assembly and value-add done in Vietnam.

What is the "China + 1" strategy, and how does it relate to Vietnam?

The "China + 1" strategy involves diversifying manufacturing operations by keeping some production in China while adding facilities in other countries. This can help reduce geopolitical risk, minimize the impact of tariffs, and boost supply chain resilience.

Vietnam is a top destination for companies taking this approach due to its proximity to China, lower labor costs, trade advantages, and increasing technical capacity.

What are some tips for successful manufacturing in Vietnam?

- Finalize product specifications, BOM, and testing protocols before engaging suppliers.

- Visit factories or work with a Western-managed firm to bridge cultural gaps.

- Use contracts with IP protection clauses and clearly defined quality expectations.

- Verify factory capacity and financial health (don’t rely solely on Alibaba listings).

- Start with a pilot run before committing to large volumes.

What are typical MOQs and lead times in Vietnam?

Manufacturing is booming in Vietnam, which has led to a bit of a “goldrush” mentality. Many suppliers are looking to maximize their margins, and prices and MOQs have risen accordingly.

Despite this, suppliers in Vietnam have more business than they can handle, so MOQs in the low to mid-thousands are still fairly common. Lead times are also about one to two weeks longer than those you would typically see in China.

To avoid issues, you may want to find a manufacturer who is flexible and accustomed to producing for small and medium-sized businesses.

Is the Vietnam manufacturing ecosystem mature enough for complex products?

Yes, particularly for electromechanical assemblies, metal fabrication, and plastic parts. However, local capacity may be limited for highly specialized components (like semiconductors and aerospace-grade alloys).

This is why the close proximity of China is actually a bonus for Vietnamese manufacturing competitiveness. It means easy and low-cost access to the massive Chinese electronics and component supply base.

While complex product manufacturing is possible, Vietnam is ideal for assembly-heavy, mid-complexity products.

What kind of products are manufactured in Vietnam?

Vietnam manufactures a wide variety of goods, including:

- Consumer electronics and components

- Metal and plastic assemblies

- Home appliances

- Furniture and home goods

- Textiles and apparel

- Packaging and industrial hardware

Electronics are concentrated in the north, textiles in the south, and general goods are produced across all regions.

What are the biggest manufacturing companies in Vietnam?

Large global players like Samsung, Foxconn, and LG operate in Vietnam. Alongside them, there are a number of regional SMEs and multinational players taking advantage of the country’s contract manufacturers.

How does Komaspec support clients in Vietnam?

Komaspec operates a vertically integrated smart factory in Hai Phong, offering:

- DFM, prototyping, and pilot production

- In-house plastic injection, sheet metal, laser cutting, and assembly

- Real-time quality control via Pivot88 and MES

- Transparent communication and engineering support

- End-to-end turnkey manufacturing for complex builds

Komaspec combines Vietnam’s cost savings and strategic location with Canadian-led service and digital execution systems.